Investment Insight | Strong returns to continue

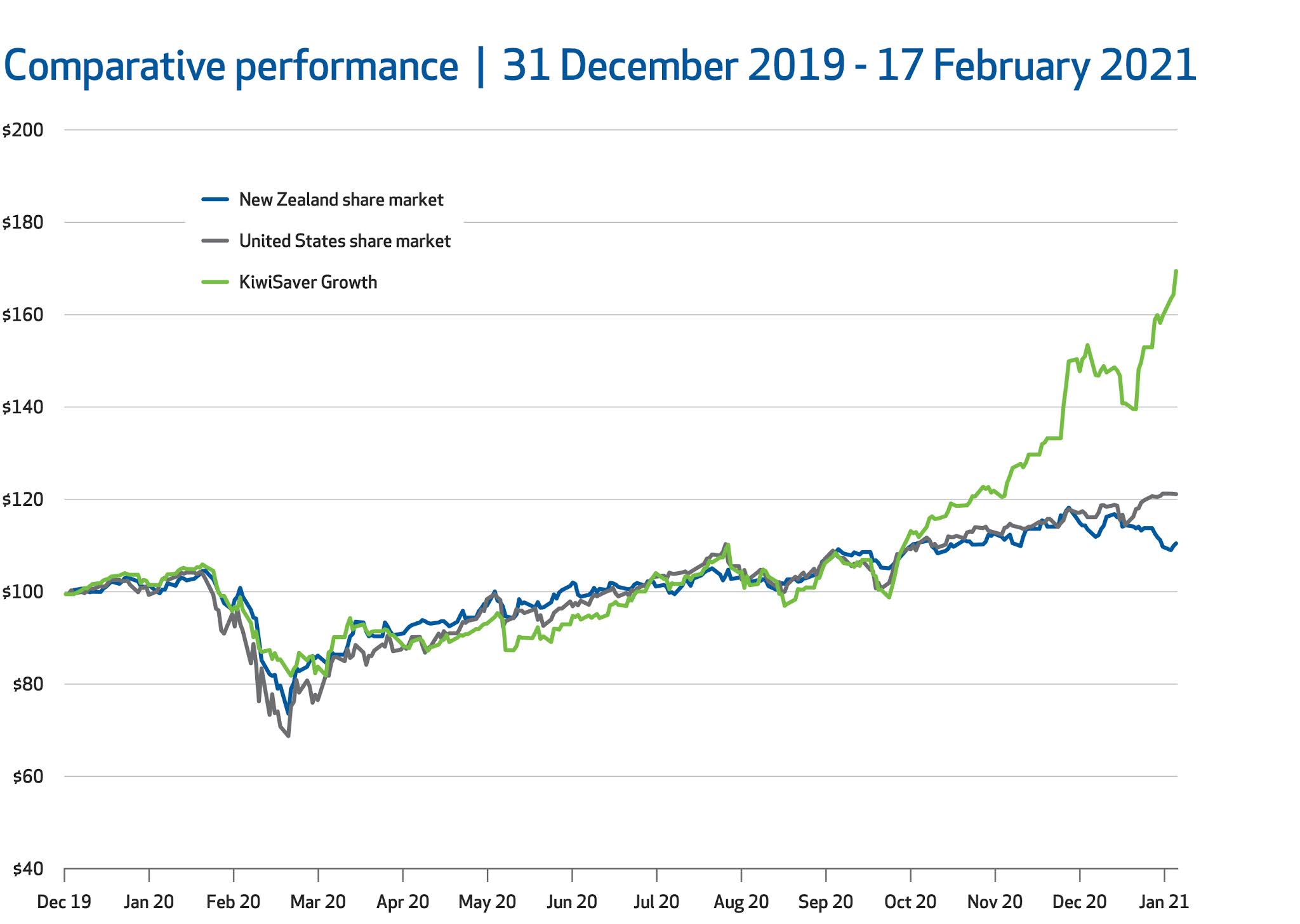

NZ Funds KiwiSaver Growth Strategy was up 33.76% in 2020, making it the top performing KiwiSaver growth fund for the year. Returns generated for clients came from a diverse range of high conviction investments across multiple asset classes and included overweight positions in global shares, credit, technology companies, small cap companies, gold, commodities, rideshare and Bitcoin.

In 2020 we believed the rollout of COVID-19 vaccines made it more likely that economic life will soon return to some version of ‘normality.’ Together with the extraordinary government stimulus and low interest rates, the opportunities for investors were immense and allowed us to aggressively position portfolios for a recovery.

2021 - Once-in-a-generation opportunity

In December we wrote how excited we were about the enormous investment opportunities for active and curious investors in 2021. We have not been disappointed. Year-to-date, NZ Funds KiwiSaver Growth Strategy is up over 27% versus the global and New Zealand share markets which are up 4.9% and down -3.2% respectively.

Furthermore, NZ Funds Income Strategy is up 4.5%, this is in stark contrast to the New Zealand and Global Bond indices which are down -1.2% and -1.3% year-to-date, driven down by rising long-term interest rates.

Like 2020, the performance generated in 2021 has come from a diverse range of investments. Many of which we discussed and positioned for in the fourth quarter of 2020, with the view that the market was underestimating the trajectory of the global economy.

Below we describe our key themes for 2021 and what has driven performance year-to-date.

Inflation risks rising

The 2008 Global Financial Crisis was an economic event with significant imbalances in the economy. The financial system needed emergency surgery and the recovery was slow and painful. This time we have been faced with a medical event from which the economy is able to return to normality in a very short space of time.

The analogy that best describes this dynamic is that of a ‘power cut’. It forces you to immediately stop what you are doing, putting huge economic burden onto households and businesses. However, once the power is back on, you can return quickly to whatever you are doing and the economy rebounds.

However, global economic activity will not return to what it was prior to the pandemic. It will be much stronger. Government stimulus and central banks slashing interest rates is like rocket fuel, providing a huge boost for the global economic recovery. It will also drive up prices, as witnessed in New Zealand across several sectors where products are in short supply.

Inflation will return and longer-term interest rates must rise. Even if short-term interest rates are held low by central banks, it is inevitable that longer-term interest rates rise as they build in both higher expected inflation and higher real interest rates as the economic recovery gathers momentum.

NZ Funds has short interest rate positions across the Income, Inflation and Growth Strategies to benefit from rising long-term interest rates.

Commodities surging

From corn to crude and copper, commodities have enjoyed a stellar start to 2021 as investors scour the market for inflation hedges. Oil is now the best performing asset year-to-date as better-than-expected demand, combined with lower-than-expected OPEC+ production, has increased the market deficit and pushed oil prices up.

Inflation is becoming more of a concern among investors because of the unprecedented monetary and fiscal policies enacted during the crisis. A weakening United States dollar is also making commodities cheaper in other currencies, fueling demand.

NZ Funds has positions in commodity futures across a range of commodities directly consumed by the consumer including coffee and gold.

Growth surging

With positive developments on the virus and vaccine fronts, we remain optimistic about economic growth in 2021. In developed markets, a post-vaccination reopening, fiscal stimulus, and pent-up savings should boost economic activity this year. However, not all share markets will continue to grow in line with the underlying economy.

Australian shares underperformed in 2020 compared to other global share markets. However, in 2021 it is beginning to march to a different tune. The market is dominated by banking shares – which have performed well in an environment of increasing interest rates – and commodity shares, which are benefiting from commodity price increases.

In 2020 we discussed how China’s leadership wants to utilise their high savings rate to incentivise domestic consumption. The Chinese government is also making significant reforms including moves to migrate household assets, predominantly held in real estate, into financial assets such as shares. China shares have generated significant outperformance for clients over the past four months.

NZ Funds has share market exposure with an overweight to Australia, Australian banks, and China.

Bitcoin

Bitcoin’s market cap — calculated by multiplying the price by the total number of coins in circulation — currently stands at more than US$500 billion. It would have to climb over 4.5 times to match the US$2.7 trillion of private sector gold investment meaning the price of Bitcoin, currently around US$50,000, would have to reach US$146,000.

Bitcoin has many of the attractive properties that have made the United States dollar, oil and gold great stores of value for centuries. In addition, Bitcoin has modernised and improved properties that position it as an attractive complement. While it certainly remains volatile, we believe it is an asset class that has diversification benefits as it becomes more institutionally accepted.

NZ Funds has bitcoin exposure in the Inflation and Growth Strategies.

The road ahead remains exciting

This environment is ideal for the NZ Funds active investment management approach. Other investment managers provide an exposure to bonds and shares. Few managers in New Zealand have the ability to profit from rising interest rates. Similarly, most managers do not have the flexibility to invest into commodities and Bitcoin

As Sir John Templeton famously described, “Bull markets are born in pessimism, grow in scepticism, mature in optimism and die in euphoria.”

March 2020 introduced widespread pessimism stretching into the third quarter. Now investor optimism abounds. While we remain positive about share markets, it is our global macro positions which make us excited about 2021. We are excited that, after such a strong start to the year across NZ Funds’ Income, Inflation and Growth Strategies, this is just the beginning.

In 2020 we believed the rollout of COVID-19 vaccines made it more likely that economic life will soon return to some version of ‘normality.’ Together with the extraordinary government stimulus and low interest rates, the opportunities for investors were immense and allowed us to aggressively position portfolios for a recovery.

2021 - Once-in-a-generation opportunity

In December we wrote how excited we were about the enormous investment opportunities for active and curious investors in 2021. We have not been disappointed. Year-to-date, NZ Funds KiwiSaver Growth Strategy is up over 27% versus the global and New Zealand share markets which are up 4.9% and down -3.2% respectively.

Furthermore, NZ Funds Income Strategy is up 4.5%, this is in stark contrast to the New Zealand and Global Bond indices which are down -1.2% and -1.3% year-to-date, driven down by rising long-term interest rates.

Like 2020, the performance generated in 2021 has come from a diverse range of investments. Many of which we discussed and positioned for in the fourth quarter of 2020, with the view that the market was underestimating the trajectory of the global economy.

Below we describe our key themes for 2021 and what has driven performance year-to-date.

Inflation risks rising

The 2008 Global Financial Crisis was an economic event with significant imbalances in the economy. The financial system needed emergency surgery and the recovery was slow and painful. This time we have been faced with a medical event from which the economy is able to return to normality in a very short space of time.

The analogy that best describes this dynamic is that of a ‘power cut’. It forces you to immediately stop what you are doing, putting huge economic burden onto households and businesses. However, once the power is back on, you can return quickly to whatever you are doing and the economy rebounds.

However, global economic activity will not return to what it was prior to the pandemic. It will be much stronger. Government stimulus and central banks slashing interest rates is like rocket fuel, providing a huge boost for the global economic recovery. It will also drive up prices, as witnessed in New Zealand across several sectors where products are in short supply.

Inflation will return and longer-term interest rates must rise. Even if short-term interest rates are held low by central banks, it is inevitable that longer-term interest rates rise as they build in both higher expected inflation and higher real interest rates as the economic recovery gathers momentum.

NZ Funds has short interest rate positions across the Income, Inflation and Growth Strategies to benefit from rising long-term interest rates.

Commodities surging

From corn to crude and copper, commodities have enjoyed a stellar start to 2021 as investors scour the market for inflation hedges. Oil is now the best performing asset year-to-date as better-than-expected demand, combined with lower-than-expected OPEC+ production, has increased the market deficit and pushed oil prices up.

Inflation is becoming more of a concern among investors because of the unprecedented monetary and fiscal policies enacted during the crisis. A weakening United States dollar is also making commodities cheaper in other currencies, fueling demand.

NZ Funds has positions in commodity futures across a range of commodities directly consumed by the consumer including coffee and gold.

Growth surging

With positive developments on the virus and vaccine fronts, we remain optimistic about economic growth in 2021. In developed markets, a post-vaccination reopening, fiscal stimulus, and pent-up savings should boost economic activity this year. However, not all share markets will continue to grow in line with the underlying economy.

Australian shares underperformed in 2020 compared to other global share markets. However, in 2021 it is beginning to march to a different tune. The market is dominated by banking shares – which have performed well in an environment of increasing interest rates – and commodity shares, which are benefiting from commodity price increases.

In 2020 we discussed how China’s leadership wants to utilise their high savings rate to incentivise domestic consumption. The Chinese government is also making significant reforms including moves to migrate household assets, predominantly held in real estate, into financial assets such as shares. China shares have generated significant outperformance for clients over the past four months.

NZ Funds has share market exposure with an overweight to Australia, Australian banks, and China.

Bitcoin

Bitcoin’s market cap — calculated by multiplying the price by the total number of coins in circulation — currently stands at more than US$500 billion. It would have to climb over 4.5 times to match the US$2.7 trillion of private sector gold investment meaning the price of Bitcoin, currently around US$50,000, would have to reach US$146,000.

Bitcoin has many of the attractive properties that have made the United States dollar, oil and gold great stores of value for centuries. In addition, Bitcoin has modernised and improved properties that position it as an attractive complement. While it certainly remains volatile, we believe it is an asset class that has diversification benefits as it becomes more institutionally accepted.

NZ Funds has bitcoin exposure in the Inflation and Growth Strategies.

The road ahead remains exciting

This environment is ideal for the NZ Funds active investment management approach. Other investment managers provide an exposure to bonds and shares. Few managers in New Zealand have the ability to profit from rising interest rates. Similarly, most managers do not have the flexibility to invest into commodities and Bitcoin

As Sir John Templeton famously described, “Bull markets are born in pessimism, grow in scepticism, mature in optimism and die in euphoria.”

March 2020 introduced widespread pessimism stretching into the third quarter. Now investor optimism abounds. While we remain positive about share markets, it is our global macro positions which make us excited about 2021. We are excited that, after such a strong start to the year across NZ Funds’ Income, Inflation and Growth Strategies, this is just the beginning.

Source: Bloomberg, NZ Funds calculations.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

James Grigor is Chief Investment Officer for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. James' comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***