Investment Insights -

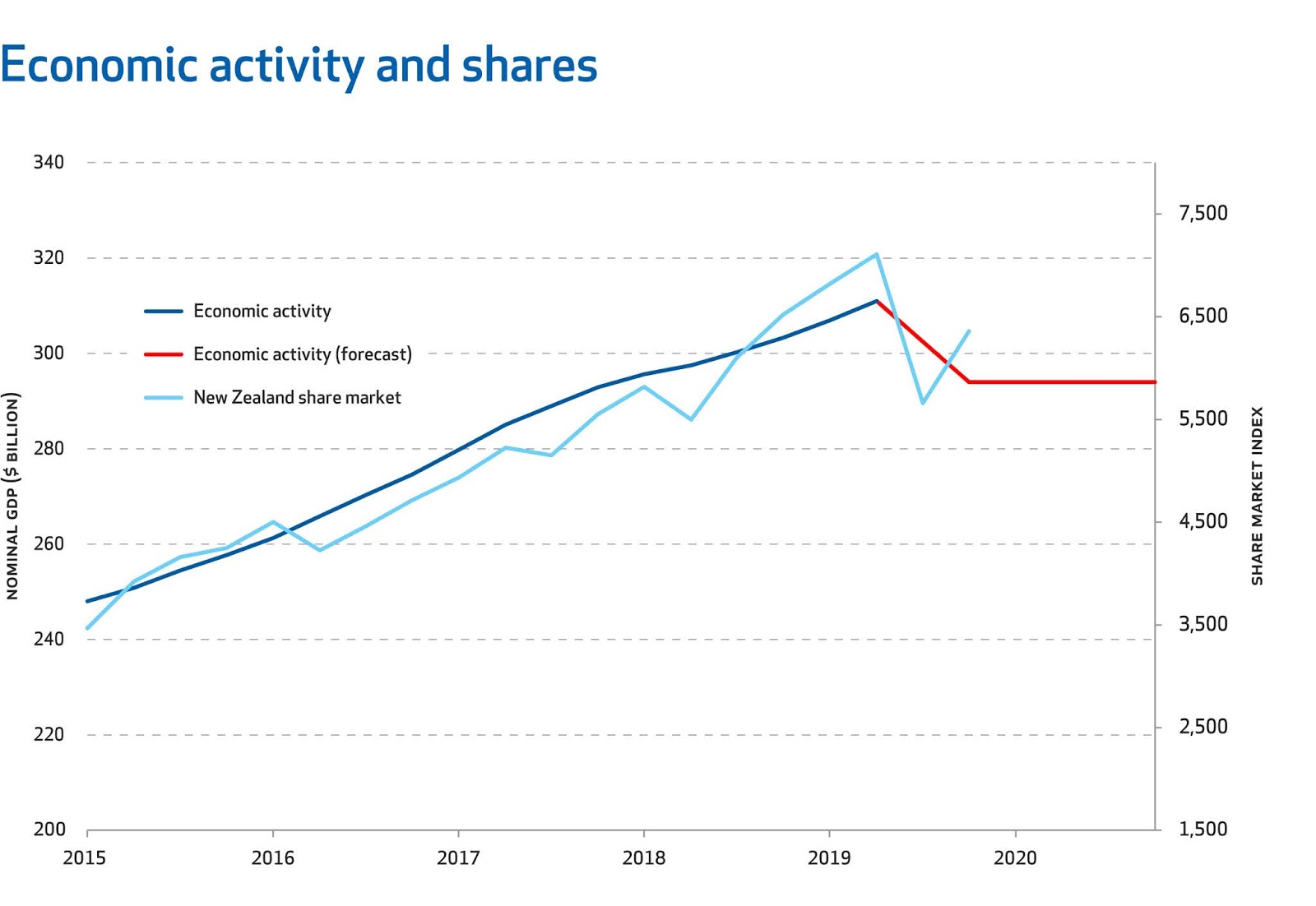

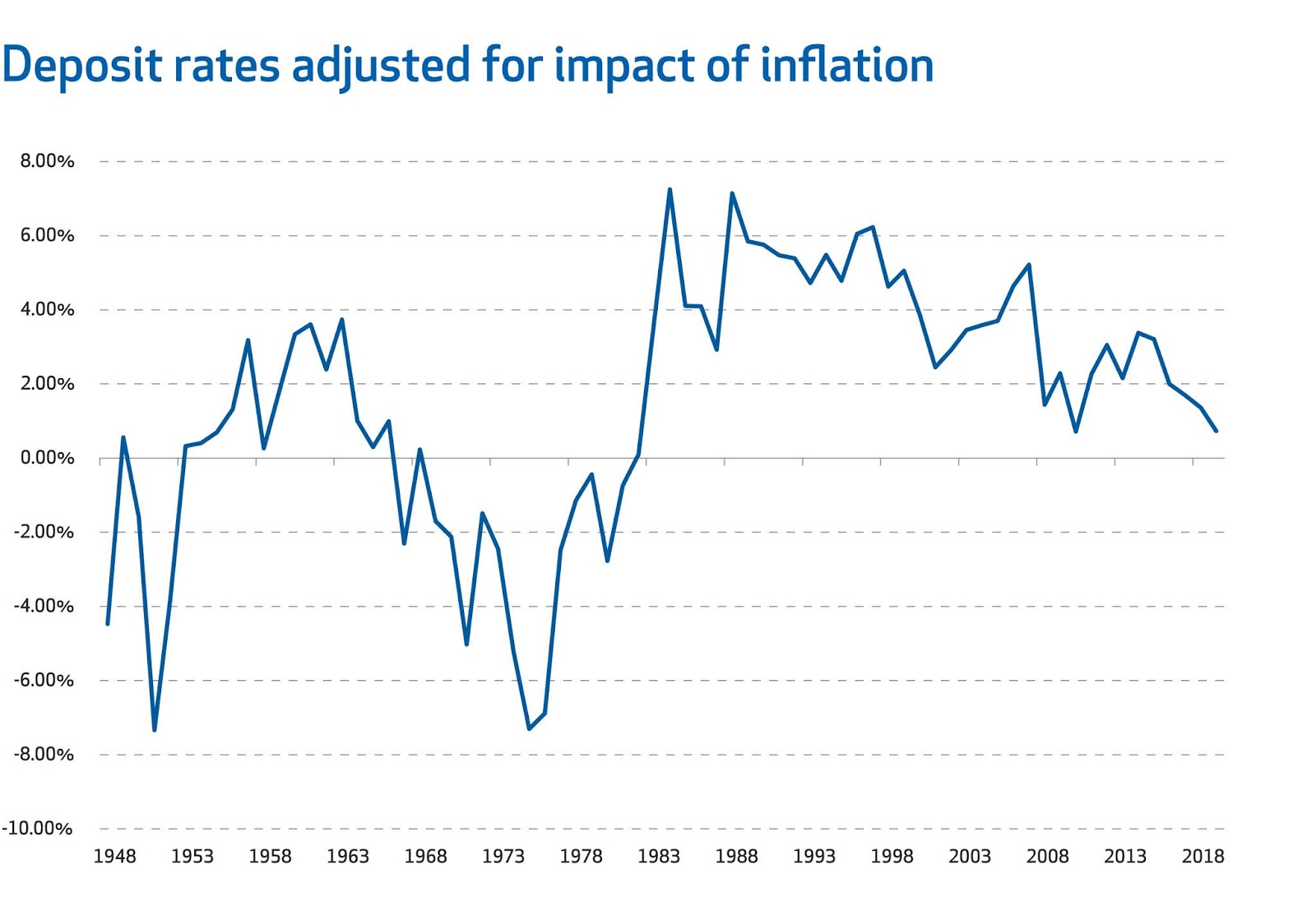

Low interest rates are a positive for shares

When COVID-19 initially appeared, some people compared it to the seasonal flu and thought it would all be over by the Northern Hemisphere Spring. It is now over 170 days since the first case in Wuhan was reported and 100 days since the World Health Organisation (WHO) declared it a global pandemic. Yet, with countries starting to remove restrictions on gatherings, we are now seeing a second wave of infections. There is, therefore, little doubt that COVID-19 will impact the global economy for a considerable period of time. The chances of New Zealand and Australia creating a travel bubble this year also seem to be receding by the day. Despite this downbeat prognosis, we remain positive towards growth assets, such as shares. As countries have relaxed their restrictions, economies have rebounded strongly. Some of this reflects pent-up demand and consumers adopting a desire to support their local communities. While we expect some of this rebound to fade, we still expect economic growth