Investment Insight | The Great Rotation

Let us dive into the current investment environment and discuss one of the current hot topics of 2021: value versus growth and why we participate in both asset categories.

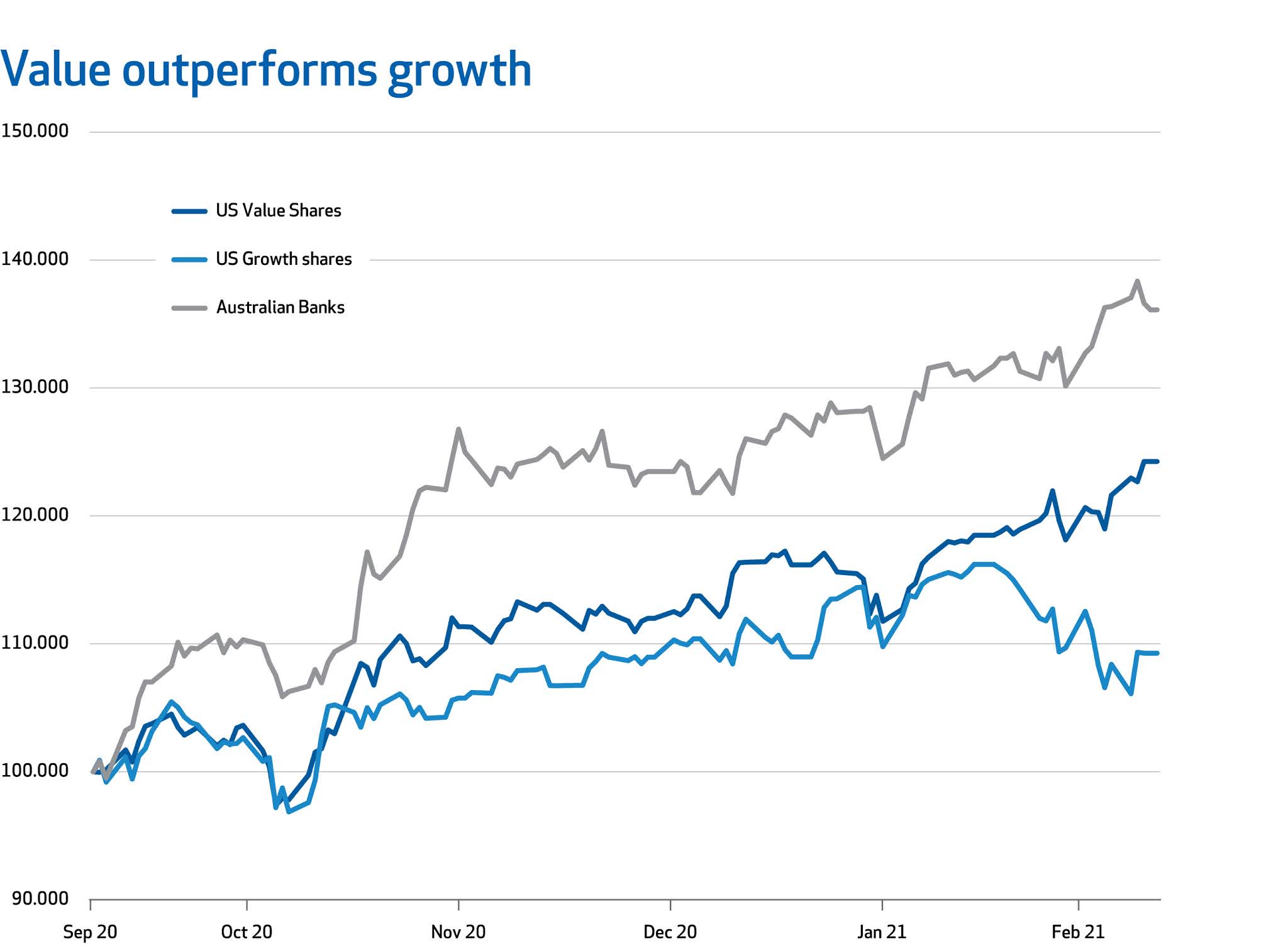

Value-investing advocates believe that value shares, characterised by their low valuations, are poised to reverse a long period of underperformance relative to their faster-growing, generally technology-driven, peers.

Growth-oriented technology shares have seen a rough stretch in 2021. The now infamous Cathie Wood of Ark Invest has been a clear example of how this reversal has affected growth strategies.

Interest rates and asset prices

Value shares usually do well in an economic recovery. Think of a well-known company such as Fletcher Building which is going through a surge in demand for its products.

At the same time, the recently announced fiscal stimulus and the expected economic recovery are likely to cause higher inflation and a rise in interest rates.

But as interest rates increase, the value of a company’s future cash flow decreases. This is one reason for the sell-off in technology shares in recent months. Meanwhile, prices of value shares have been more stable.

The end of tech?

High valuations are making the art of investing in technology shares more interesting – or more dangerous, depending on how you look at it.

While rising interest rates can put downward pressure on technology share prices, economic optimism can have the opposite effect. We expect themes such as the ongoing shift toward mobile and cloud computing to continue supporting the sector.

NZ Funds generated strong returns for clients from technology in 2020. This year, our positioning in technology shares is predominantly active rather than passive, meaning the best companies within the sector are selected, as opposed to the sector as a whole.

Gold and the store of value

It is not only technology shares that suffer from higher-than-expected interest rates. A store of value, such as gold, is anything that holds its purchasing power in the future. It is a function of people’s perception of worth.

As interest rates increase so does the opportunity cost of holding these assets. NZ Funds exited our gold position last year, after making significant returns for clients.

2021 – intelligent investment approach

As the market looks to rotate from growth to value, we look to deploy capital in areas that will generate outsized returns over a three to five year period. This includes banks, commodities, clean energy, selected technology names and short interest rate futures.

A great example of this is Australian shares, which underperformed in 2020 compared to other global share markets. However, in 2021 they are beginning to march to a different tune. The Australian market is dominated by banking shares which perform well in an environment of increasing interest rates. Banks are, after all, value shares and this is a sector we think will outperform significantly over the next few years.

Commodities and commodity shares are also benefiting from increasing economic activity. NZ Funds’ clients have benefitted from a diverse range of commodity investments including gasoline, coffee, carbon credits and clean energy – all invested within our stringent Responsible Investment guidelines.

The global business cycle provides opportunities to invest across many asset classes and enables us to generate strong and sustainable returns for our clients. Our intelligent investment approach means we have the tools, infrastructure and capability to invest in the building blocks of any successful portfolios — shares and bonds — but also in asset classes which perform well as the market rotates into a different investment regime.

We are excited about what the next year will bring. The market is ripe for opportunities and we are humbled to have our clients on this journey with us.

Value-investing advocates believe that value shares, characterised by their low valuations, are poised to reverse a long period of underperformance relative to their faster-growing, generally technology-driven, peers.

Growth-oriented technology shares have seen a rough stretch in 2021. The now infamous Cathie Wood of Ark Invest has been a clear example of how this reversal has affected growth strategies.

Interest rates and asset prices

Value shares usually do well in an economic recovery. Think of a well-known company such as Fletcher Building which is going through a surge in demand for its products.

At the same time, the recently announced fiscal stimulus and the expected economic recovery are likely to cause higher inflation and a rise in interest rates.

But as interest rates increase, the value of a company’s future cash flow decreases. This is one reason for the sell-off in technology shares in recent months. Meanwhile, prices of value shares have been more stable.

The end of tech?

High valuations are making the art of investing in technology shares more interesting – or more dangerous, depending on how you look at it.

While rising interest rates can put downward pressure on technology share prices, economic optimism can have the opposite effect. We expect themes such as the ongoing shift toward mobile and cloud computing to continue supporting the sector.

NZ Funds generated strong returns for clients from technology in 2020. This year, our positioning in technology shares is predominantly active rather than passive, meaning the best companies within the sector are selected, as opposed to the sector as a whole.

Gold and the store of value

It is not only technology shares that suffer from higher-than-expected interest rates. A store of value, such as gold, is anything that holds its purchasing power in the future. It is a function of people’s perception of worth.

As interest rates increase so does the opportunity cost of holding these assets. NZ Funds exited our gold position last year, after making significant returns for clients.

2021 – intelligent investment approach

As the market looks to rotate from growth to value, we look to deploy capital in areas that will generate outsized returns over a three to five year period. This includes banks, commodities, clean energy, selected technology names and short interest rate futures.

A great example of this is Australian shares, which underperformed in 2020 compared to other global share markets. However, in 2021 they are beginning to march to a different tune. The Australian market is dominated by banking shares which perform well in an environment of increasing interest rates. Banks are, after all, value shares and this is a sector we think will outperform significantly over the next few years.

Commodities and commodity shares are also benefiting from increasing economic activity. NZ Funds’ clients have benefitted from a diverse range of commodity investments including gasoline, coffee, carbon credits and clean energy – all invested within our stringent Responsible Investment guidelines.

The global business cycle provides opportunities to invest across many asset classes and enables us to generate strong and sustainable returns for our clients. Our intelligent investment approach means we have the tools, infrastructure and capability to invest in the building blocks of any successful portfolios — shares and bonds — but also in asset classes which perform well as the market rotates into a different investment regime.

We are excited about what the next year will bring. The market is ripe for opportunities and we are humbled to have our clients on this journey with us.

Source: Bloomberg.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

James Grigor is Chief Investment Officer for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. James' comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***