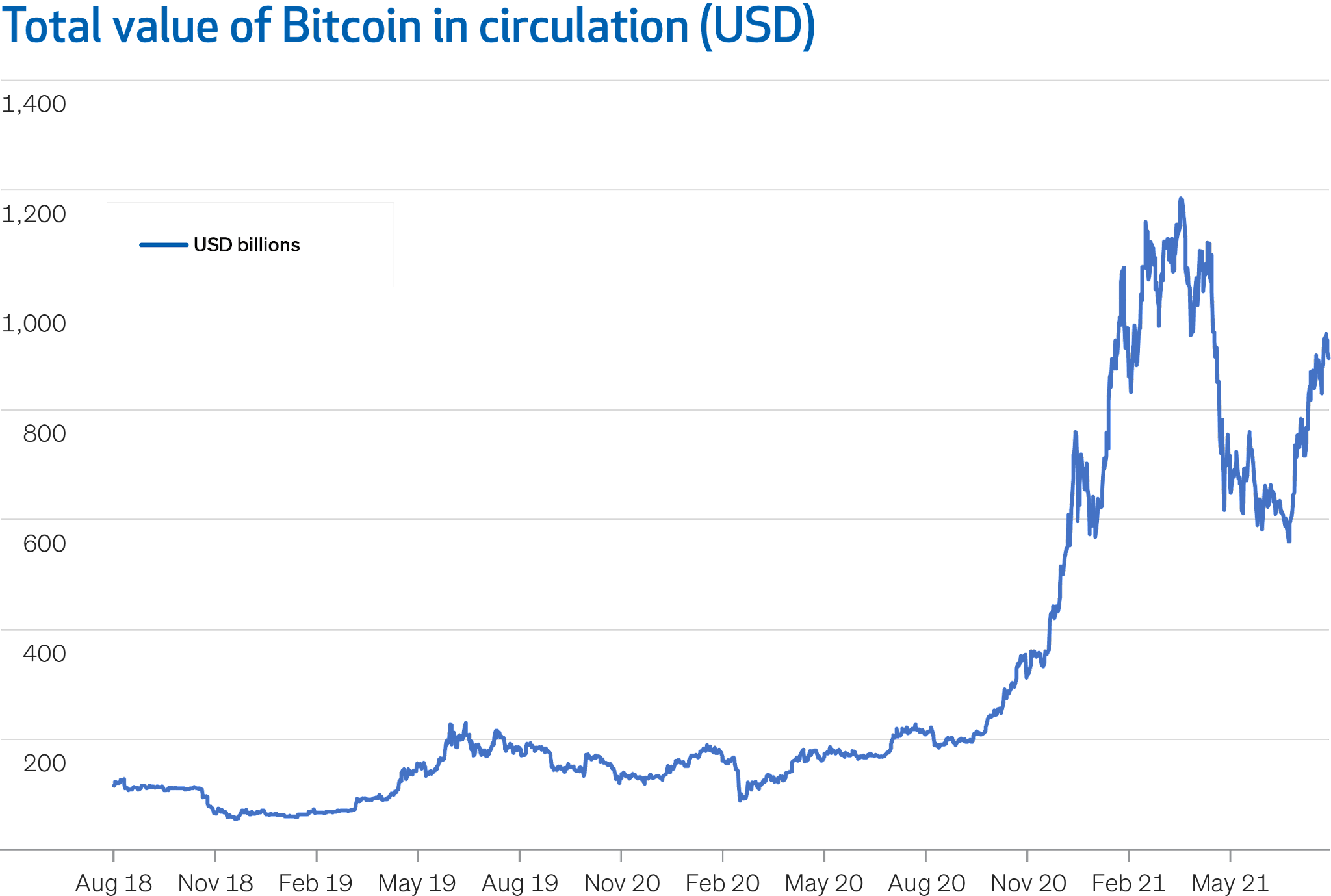

Investment Insight | Bitcoin - here to stay

Cryptocurrency markets have expanded dramatically in the thirteen years since an anonymous author published the Bitcoin white paper. While all cryptocurrencies share common features (primarily, they are distributed networks secured via cryptography) the structure of the individual assets and their intended real-world use cases have become more diverse. The two largest coins, Bitcoin and Ethereum, still account for a large majority of market capitalisation. According to CoinMarketCap.com, there are nearly 6,000 cryptocurrencies in the marketplace today with a total market capitalisation of $2.0 trillion. For comparison, the total market value of bonds covered by the Bloomberg-Barclays US Corporate High Yield Index is $1.67 trillion, while the market cap of the S&P 500 is approximately $39 trillion. Bitcoin currently accounts for 44% of the total cryptocurrency market, while Ethereum accounts for about 20%. Given its dominant position, the remainder of this article will focus o