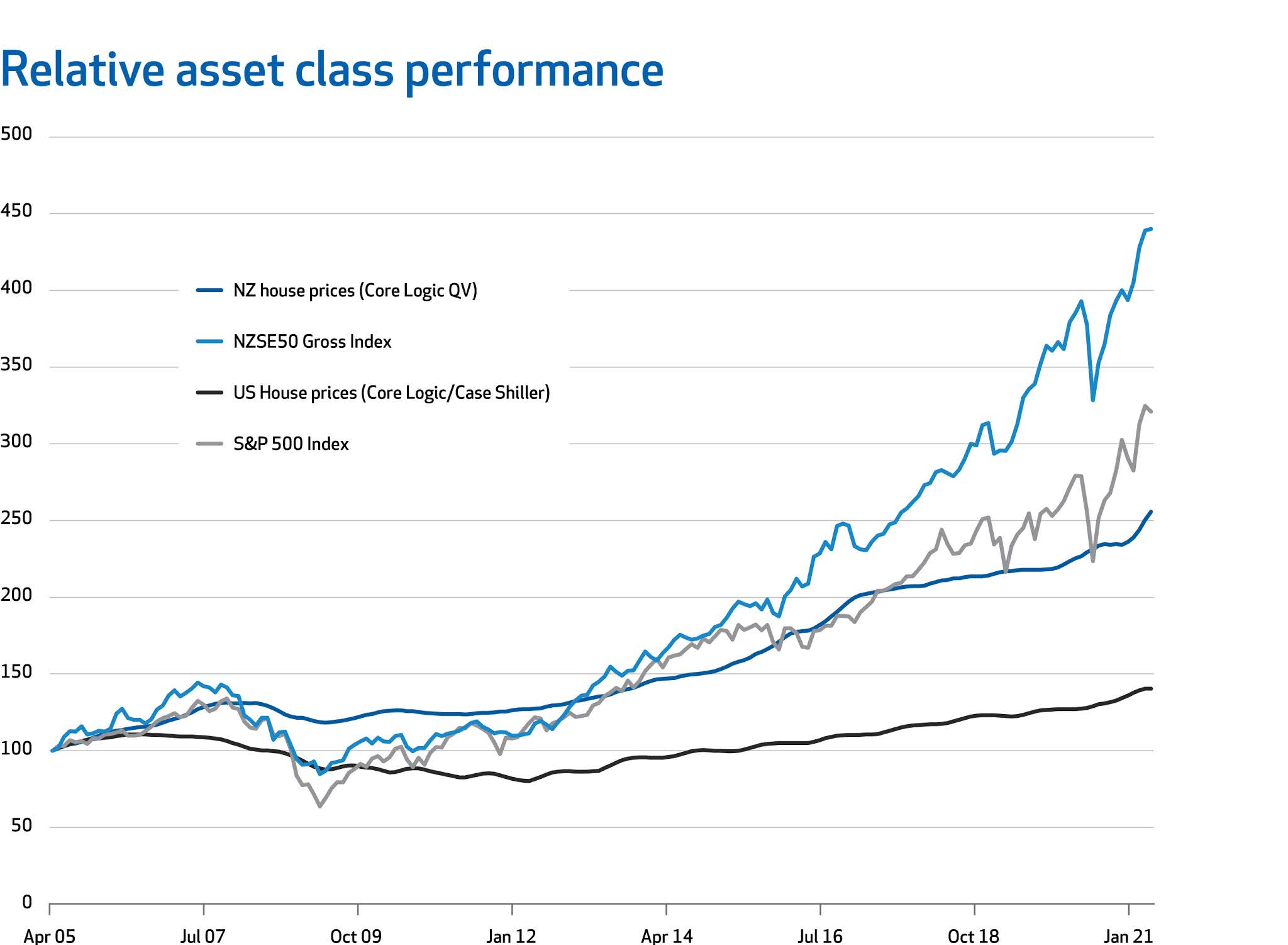

Investment Insight | All your eggs in one asset basket

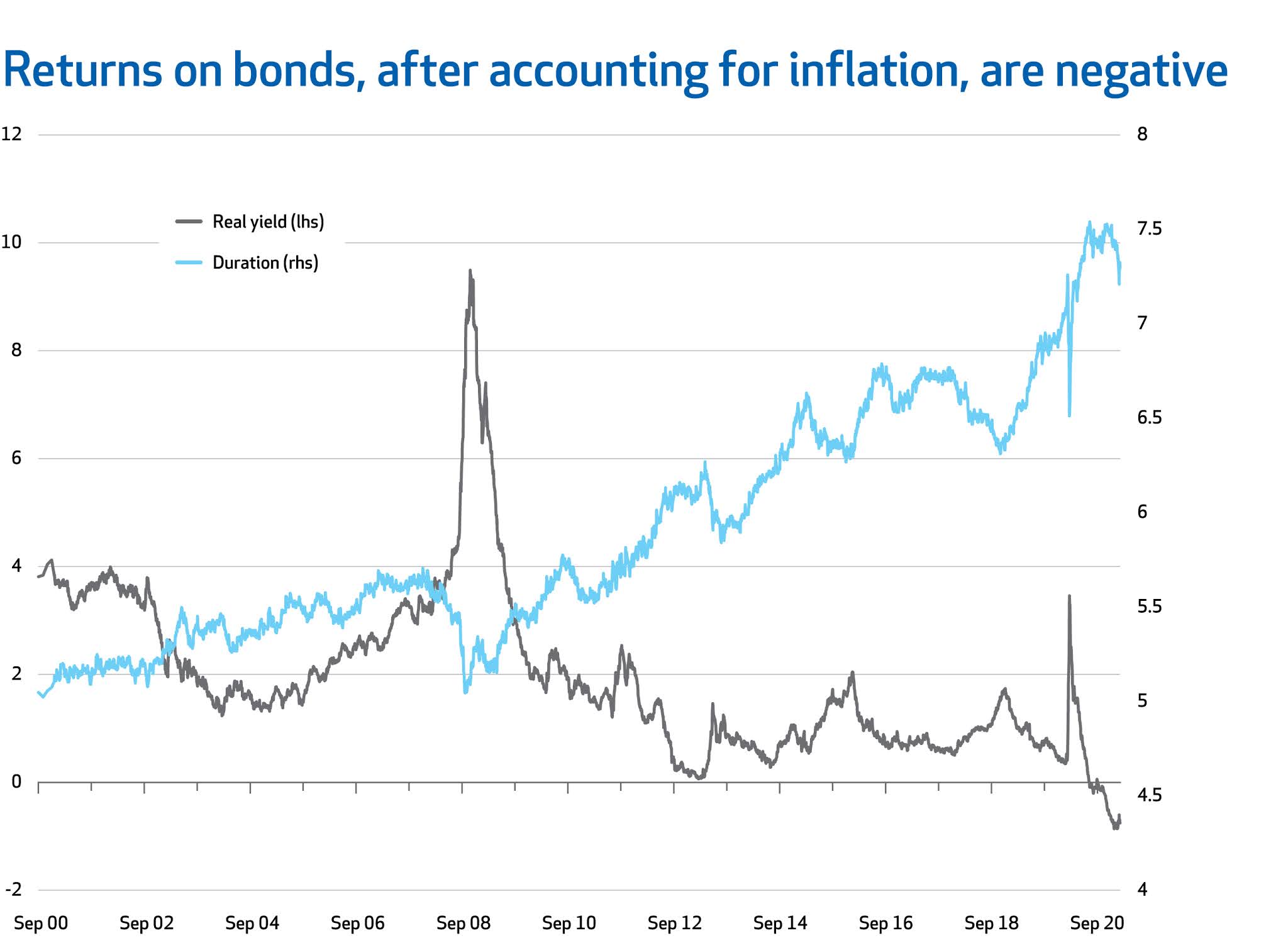

House prices to fall 10%! This was one of many headlines that came out of the Government's housing policy announcement this week. The policy aims to reduce speculation in the residential property market and help first home buyers. The package of measures will likely impact house prices at the margin. But given the staged implementation, it will take some time to play out. Escaping the headlines, the meteoric rise of housing is predominantly due to one factor; interest rates. John Key, in his role as ANZ chairman, recently commented that “low interest rates are really what's fuelling this, probably more than anything else." Interest rate risk It is interest rates that will dictate where property prices go from here. If interest rates remain low, the demand for property will remain and prices will remain high. However, as interest rates increase, financing becomes more difficult and debt servicing expensive. Demand will drop. Supply of investment properties