30 years in business

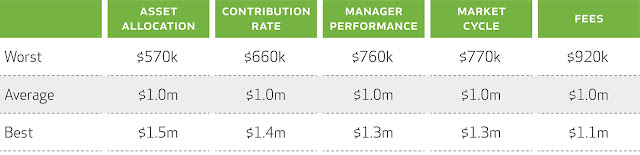

Why asset allocation and advice beat everything else. Financial advice is much like other professional services; if clients put their mind to it they could probably do most of it themselves. Little of it is rocket science. But just as we don’t want to spend our weekend doing the family’s tax returns, writing a will or establishing a trust, an increasing number of New Zealanders are embracing the use of a financial adviser to ensure they get the basics right. So, if you have decided to make a living advising others what to do with their money, you will want to know the best way to grow your clients’ wealth, and then recommend that to as many clients as possible. The good news is, in our view, the formula for success as a financial adviser is surprisingly simple. What is also surprisingly simple is that experts around the world from Buffett to Bogle agree that it has little to do with active or passive, global or local, choice of manager or how much they charge; and