KiwiSaver Insight - Retirement decisions based on science not spin

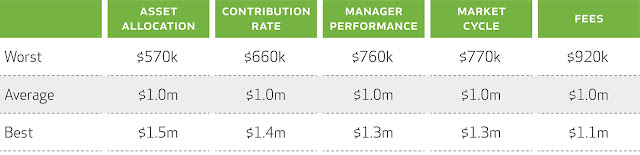

KiwiSaver is rapidly proving as much of a bonanza for the marketing industry as it is for the wealth management industry. Some providers are spending seven figures annually to promote their various investment propositions. And as one would expect, if you let the ad executives loose, the key messages are, well… 'loose'. In addition to surveying clients to determine what they want out of KiwiSaver (see Good Returns article What New Zealanders want from KiwiSaver may surprise you ), NZ Funds has been researching what really determines how much money a KiwiSaver member retires with. The answers are logical and intuitive to long-term practitioners of financial advice, but will no doubt come as a shock to fans of Mad Men. To answer the question: "What matters most in maximising KiwiSaver by retirement?" the NZ Funds Wealth Technology Team started with an 18 year old on the average full-time youth earnings of $38,324 per annum. The 18 year old’s earnings increase