Investment Insights -

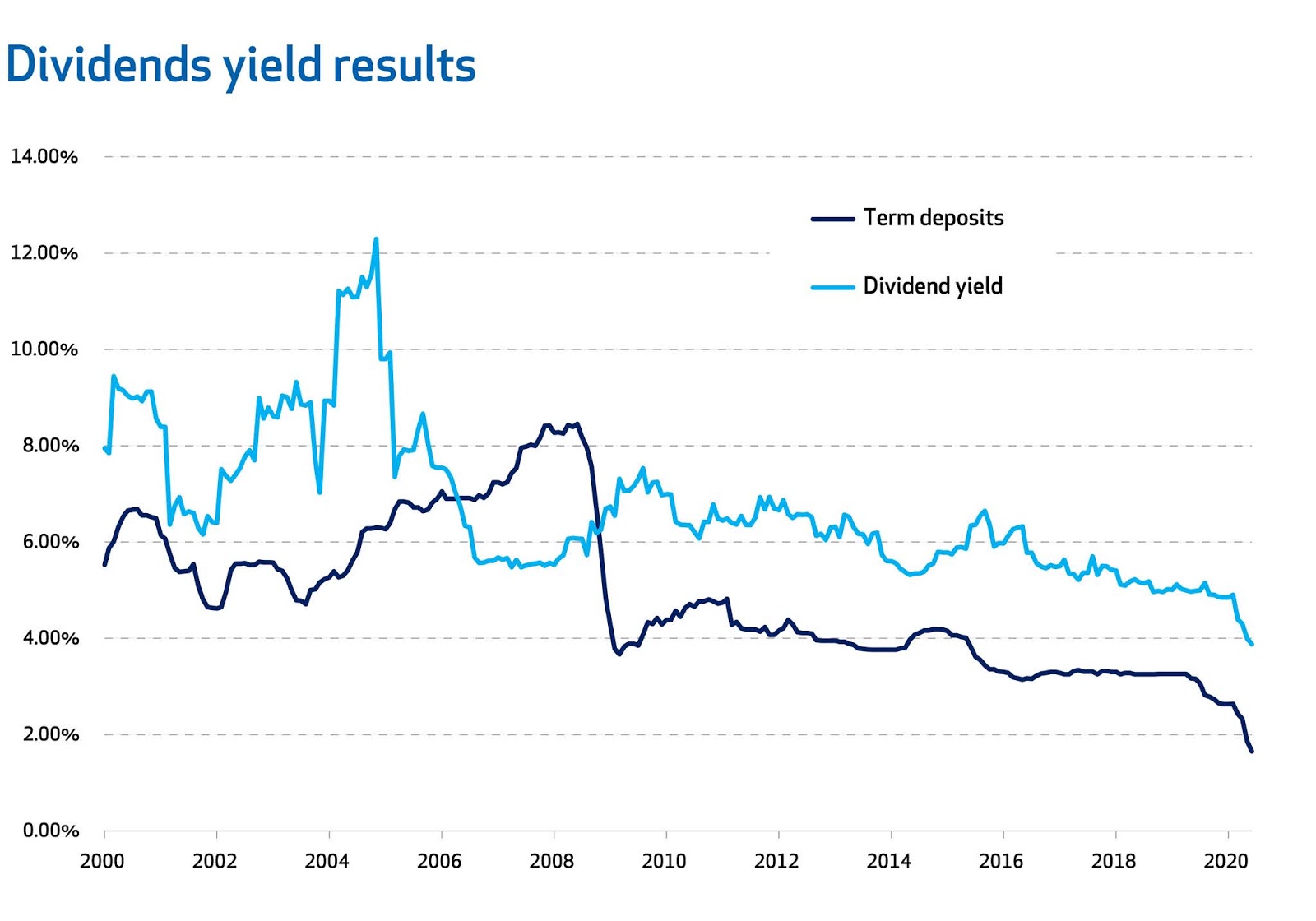

Dividends yield results

NZ Funds has continuously managed New Zealand shares in-house since 1992. As a result, we have one of New Zealand’s longest standing domestic share investment track records. Today, New Zealand shares remain a key driver of returns for NZ Funds clients’ growth and inflation portfolios. One aspect of the New Zealand share market which makes it such a rich hunting ground to invest is the dividend yield of New Zealand companies when compared with other global markets. In this article we discuss why dividend paying companies are an attractive investment. We will also review some of our favourite New Zealand companies that clients are currently invested in. Dividends form a significant component of a company’s total return According to EY, Australia and New Zealand are two of only a handful of countries with a dividend imputation regime. By substantially removing the double taxation, EY believes the regime in New Zealand replicates a near tax-free marketplace and, accordingly, imp