Special announcement: COVID-19

Market update 8 – A tale of two markets

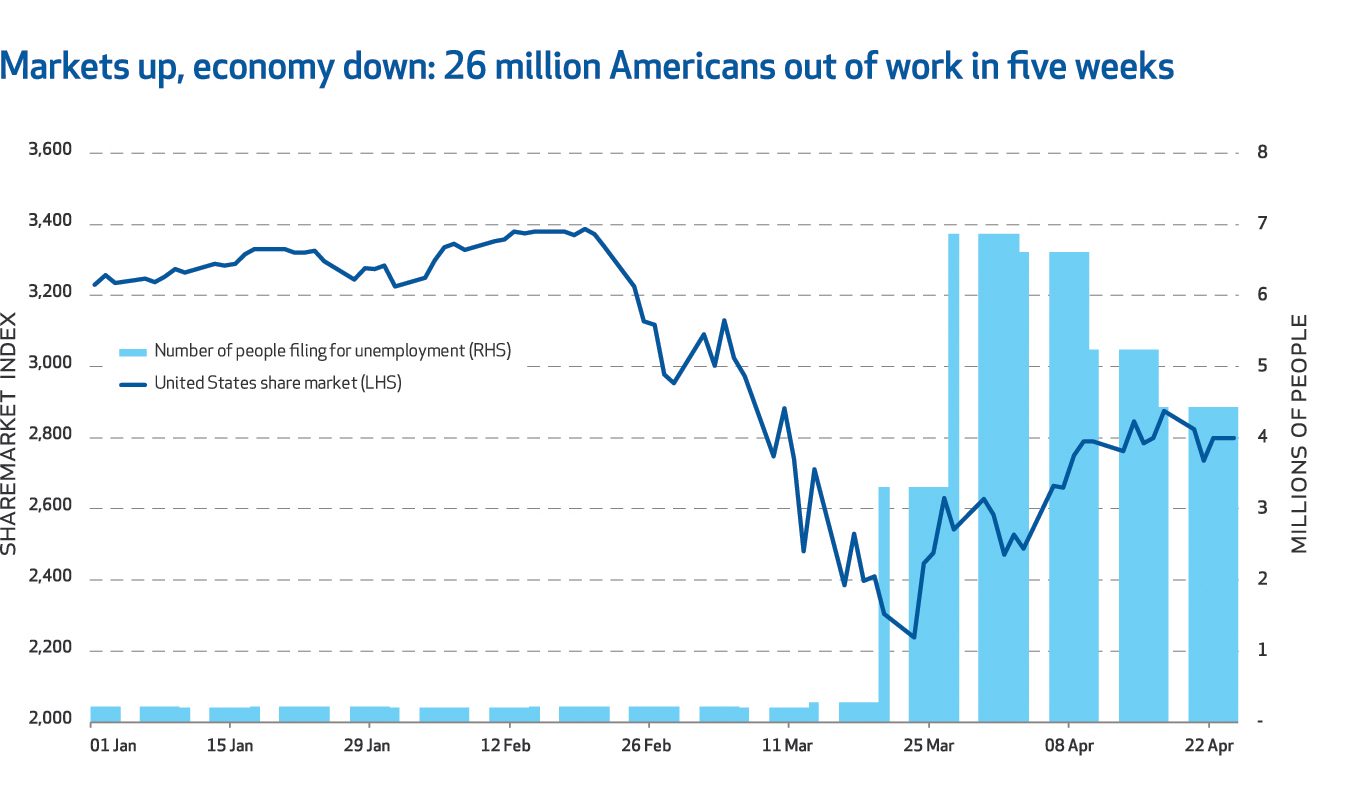

At the turn of the year, we had a positive view of financial markets. Geopolitical tensions in Iran failed to escalate, and the United States – China trade war had started to subside. The outlook was bright. However, following NZ Funds’ research trip to Hong Kong in mid-January, we witnessed first-hand how Asian economies were reacting to a newly discovered virus. It was touch-and- go whether we could easily return to New Zealand given rumours Hong Kong airport would close due to the virus. We immediately pivoted clients’ portfolios to become moderately defensive. As we continued to discuss the spread of the virus with our global network of experts, we believed markets were being complacent and struggling to gauge (what was now called) COVID-19’s economic impacts. In 10 March 2020 | Market Update 1 , we explained how NZ Funds took steps to mitigate the effect of further financial market volatility and hedged 50% of clients’ share market exposure. There was no better time to buy