Investment Insight | Outperforming the market

On 17 April we wrote that the road to recovery for the global economy would be long, reflecting the reality of the economic ‘sudden stop’. Although global share markets were 22% off their lows of 23 March they were still down -15%.

At the same time, a typical NZ Funds KiwiSaver Growth client was down just -6.5%, highlighting NZ Funds’ success in mitigating the downside.

We also wrote in April that with company valuations significantly lower, and interest rates near zero, there will be large capital flows into share markets, driving up share prices, and the pace of improvement could be fast. We forecast that we would continue to see an upside in share markets over the next 12 – 24 months and thus we had positioned clients’ portfolios to continue to fully participate in the recovery.

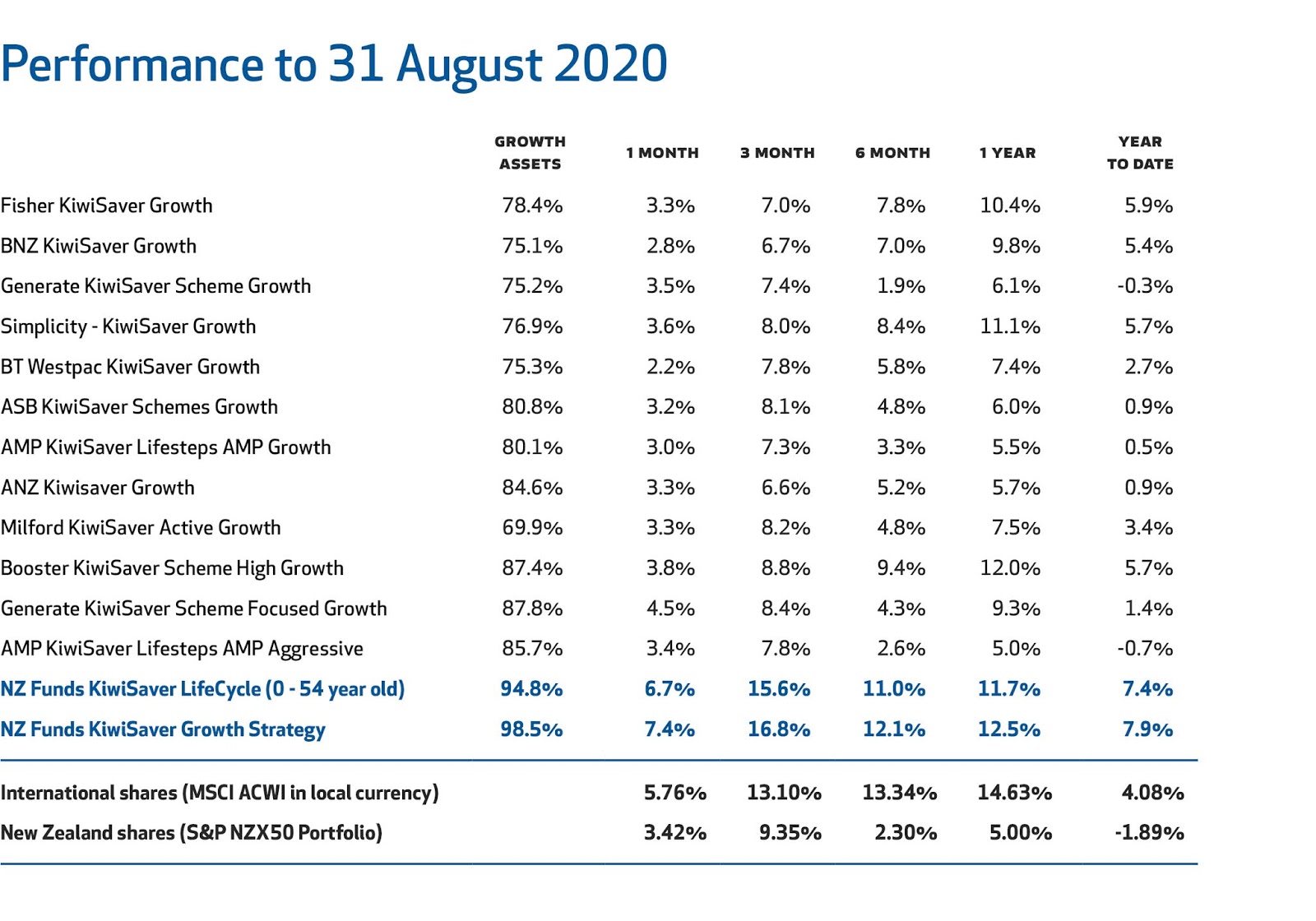

Some five months later, after mitigating the downside in March and following our positive view in April, NZ Funds has again outperformed our major competitors, this time in a rising market. With global markets up 4.1% for the eight months to the end of August and 33.9% off their 23 March lows, the typical NZ Funds KiwiSaver Growth client is up 7.9%, outperforming clients of our major competitors, and the New Zealand share market which is still down -1.9% for the year to the end of August, as illustrated in the table.

Performance changes over time

As an active manager, NZ Funds will often generate returns higher than our competitors and domestic and global benchmarks. At times, our returns will be lower. Of paramount importance is our ability to mitigate the downside for our clients, and then have those same clients fully participate in the market rebound.

Our success in generating strong returns for clients in 2020, despite the uncertainty around COVID-19 from an economic and health perspective, highlights the tools at NZ Funds disposal to generate returns. NZ Funds’ multi-dimensional investment strategy means we can take positions in themes and opportunities, in New Zealand and globally, which a vanilla or passive share portfolio cannot do. This has driven our strong performance over the last couple of months.

Key themes that have driven client returns since April have been an overweight to global shares, and tactical tilts to technology shares and gold. Client returns also reflect the strong performance of our global investment managers who have been instrumental in generating above benchmark returns across the global markets in which we invest.

Our active currency management has also been of significance. Instead of taking a passive view on currency, we maintain active positions. At the start of the pandemic client portfolios were overweight the United States dollar, considered a safe haven at times of crisis. We then fully hedged all client portfolios back to the New Zealand dollar when it became obvious that New Zealand had been successful in mitigating the worst of the pandemic.

Asset allocation drives 96% of the variation of returns

A lot more will happen before 2020 is over. Three months from now, the United States and New Zealand elections will be behind us and there is a good chance that we will be on the verge of an approved COVID-19 vaccine. We recently discussed how we have positioned client portfolios for the commencement of a cyclical upswing. It is worth remembering, and the last couple of weeks are a reminder, that the journey will remain volatile. For those clients with long-term investment horizons, the best strategy is to look beyond the short term, ensure your asset allocation reflects your personal circumstances and use any market weakness to rebalance and invest. All these decisions can be discussed with your trusted financial adviser.

At the same time, a typical NZ Funds KiwiSaver Growth client was down just -6.5%, highlighting NZ Funds’ success in mitigating the downside.

We also wrote in April that with company valuations significantly lower, and interest rates near zero, there will be large capital flows into share markets, driving up share prices, and the pace of improvement could be fast. We forecast that we would continue to see an upside in share markets over the next 12 – 24 months and thus we had positioned clients’ portfolios to continue to fully participate in the recovery.

Some five months later, after mitigating the downside in March and following our positive view in April, NZ Funds has again outperformed our major competitors, this time in a rising market. With global markets up 4.1% for the eight months to the end of August and 33.9% off their 23 March lows, the typical NZ Funds KiwiSaver Growth client is up 7.9%, outperforming clients of our major competitors, and the New Zealand share market which is still down -1.9% for the year to the end of August, as illustrated in the table.

Performance changes over time

As an active manager, NZ Funds will often generate returns higher than our competitors and domestic and global benchmarks. At times, our returns will be lower. Of paramount importance is our ability to mitigate the downside for our clients, and then have those same clients fully participate in the market rebound.

Our success in generating strong returns for clients in 2020, despite the uncertainty around COVID-19 from an economic and health perspective, highlights the tools at NZ Funds disposal to generate returns. NZ Funds’ multi-dimensional investment strategy means we can take positions in themes and opportunities, in New Zealand and globally, which a vanilla or passive share portfolio cannot do. This has driven our strong performance over the last couple of months.

Key themes that have driven client returns since April have been an overweight to global shares, and tactical tilts to technology shares and gold. Client returns also reflect the strong performance of our global investment managers who have been instrumental in generating above benchmark returns across the global markets in which we invest.

Our active currency management has also been of significance. Instead of taking a passive view on currency, we maintain active positions. At the start of the pandemic client portfolios were overweight the United States dollar, considered a safe haven at times of crisis. We then fully hedged all client portfolios back to the New Zealand dollar when it became obvious that New Zealand had been successful in mitigating the worst of the pandemic.

Asset allocation drives 96% of the variation of returns

A lot more will happen before 2020 is over. Three months from now, the United States and New Zealand elections will be behind us and there is a good chance that we will be on the verge of an approved COVID-19 vaccine. We recently discussed how we have positioned client portfolios for the commencement of a cyclical upswing. It is worth remembering, and the last couple of weeks are a reminder, that the journey will remain volatile. For those clients with long-term investment horizons, the best strategy is to look beyond the short term, ensure your asset allocation reflects your personal circumstances and use any market weakness to rebalance and invest. All these decisions can be discussed with your trusted financial adviser.

Source: Bloomberg, FE Analytics, June 2020 Fund Updates. Returns are after fees and before tax.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

James Grigor is Chief Investment Officer for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. James' comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***