Investment Insight | Change vs more of the same?

What do the New Zealand listed blue chip utility companies, such as Meridian and Contact Energy, have in common with some of the super growth stocks listed on the United States Nasdaq index such as Zoom and Virgin Galactic? At first look there are not a lot of similarities!

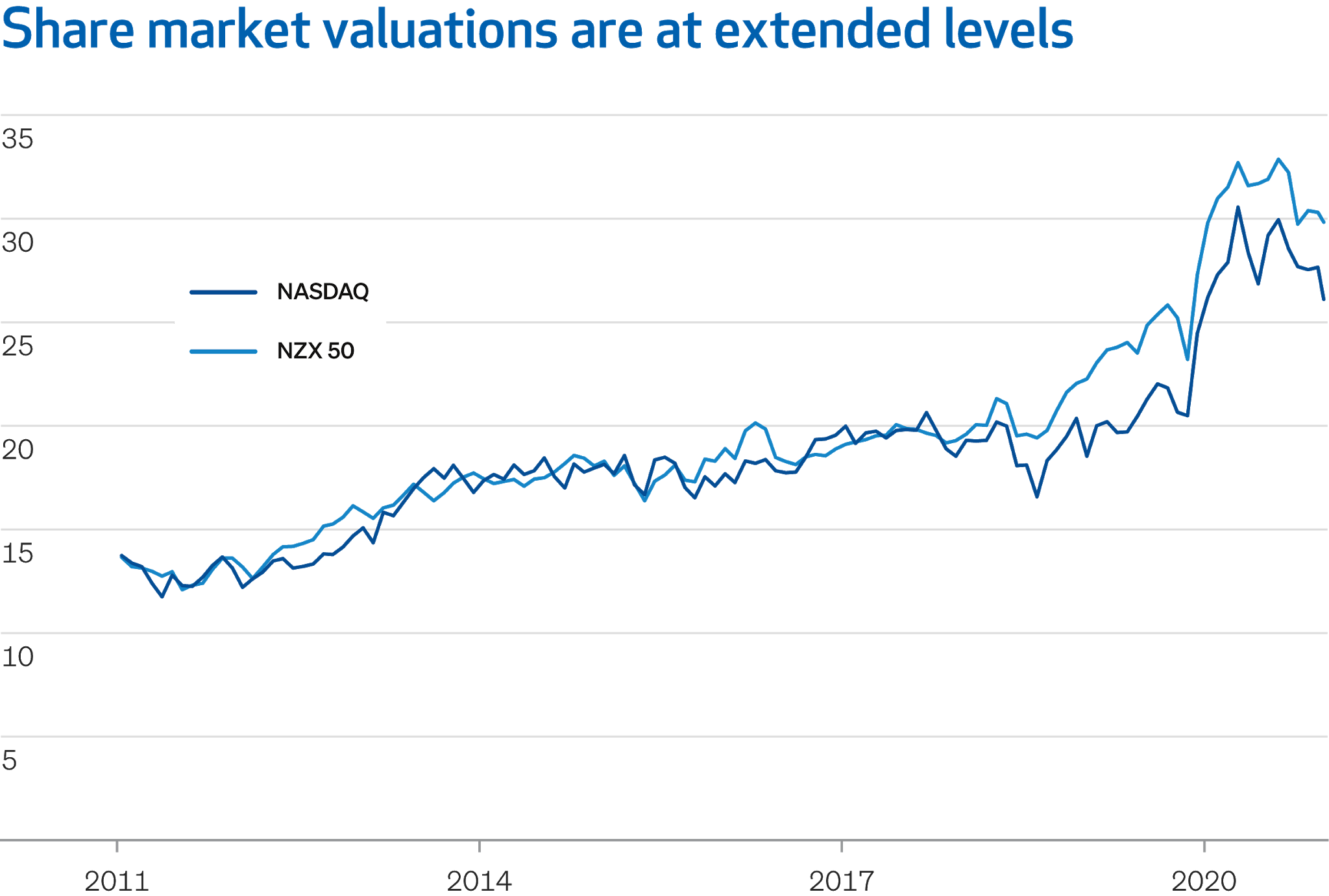

The chart below (Share market valuations are at extended levels) provides a hint. While the companies that comprise the two indices are very different, there is an underlying relationship - they are both richly valued, as measured by their price to earnings ratio (P/E), relative to their own history and relative to other markets such as the S&P 500.

One of the key factors that drives the valuation of all assets is interest rates; however, the importance it has on valuation varies. It tends to be of limited impact for a company that is generating strong current cashflow and has high margins, such as a casino share like Sky City.

Many of the largest companies in the New Zealand share market are mature businesses with very stable and predictable cashflows – companies such as Spark, Meridian, Contact and the listed property companies. The stable nature of their earnings mean that their cashflows look very similar to the predictable (fixed) cashflows that a bond would generate. As a result, these shares are often viewed as ‘bond proxies’. Investors will compare the dividend yield they can get from these companies with the yield available from bonds.

We are living in a world where interest rates have been falling for 40 years. So, as the bond yield has fallen, investors have been willing to accept a low yield from bond proxy shares. The yield is simply the earnings divided by price (E/P), the inverse of the P/E ratio. Therefore, as the yield falls the P/E ratio must rise. Ultra-low interest rates are an important factor behind the elevated valuation of the New Zealand share market and its strong performance over the last ten years.

Clearly, Nasdaq shares are not bond proxies. The businesses listed on this index are mostly young and fast growing. Their earnings, if they have any, will not be generated until some time way into the future.

So how do interest rates impact the valuation of this type of asset? Interest rates determine how much we need to discount cashflows that occur in the future. If interest rates are high, then cashflows that occur years from now are of little value in today’s dollars.

Conversely, if interest rates are ultra low, as they have been over the last year, then there is little difference between the value of a dollar today versus a dollar in the future. This means that as interest rates fall, the current value of the earnings that technology companies can generate in the future become significantly more valuable. This helps to explain the strong performance of the Nasdaq index during 2020.

Investors need to understand the investment regime that they are in as this will have an important outcome on the likely returns. We are of the view that interest rates are not going to continue their 40-year trend ever lower and that they will rise. This means that the investment strategies that have worked for the last 10 years are unlikely to be the home run winners for the next 10 years. Translating this into how we are positioning client portfolios, we see the New Zealand share market as generally expensive and do not expect the same 13%+ per annum returns that it has achieved over the last 10 years. Instead, we are more optimistic towards share markets such as Australia.

Turning to the technology-heavy Nasdaq index, we are of the view that interest rates will be a headwind for the most highly valued companies which are yet to become profitable. However, this does not mean that we are negative on the technology sector in general, as many of the more mature technology companies – such as Amazon, Apple, Adobe and Facebook – generate significant current profits and are much more reasonably valued. Ultimately this is where clients will benefit from the NZ Funds active investment management approach.

The chart below (Share market valuations are at extended levels) provides a hint. While the companies that comprise the two indices are very different, there is an underlying relationship - they are both richly valued, as measured by their price to earnings ratio (P/E), relative to their own history and relative to other markets such as the S&P 500.

One of the key factors that drives the valuation of all assets is interest rates; however, the importance it has on valuation varies. It tends to be of limited impact for a company that is generating strong current cashflow and has high margins, such as a casino share like Sky City.

Many of the largest companies in the New Zealand share market are mature businesses with very stable and predictable cashflows – companies such as Spark, Meridian, Contact and the listed property companies. The stable nature of their earnings mean that their cashflows look very similar to the predictable (fixed) cashflows that a bond would generate. As a result, these shares are often viewed as ‘bond proxies’. Investors will compare the dividend yield they can get from these companies with the yield available from bonds.

We are living in a world where interest rates have been falling for 40 years. So, as the bond yield has fallen, investors have been willing to accept a low yield from bond proxy shares. The yield is simply the earnings divided by price (E/P), the inverse of the P/E ratio. Therefore, as the yield falls the P/E ratio must rise. Ultra-low interest rates are an important factor behind the elevated valuation of the New Zealand share market and its strong performance over the last ten years.

Clearly, Nasdaq shares are not bond proxies. The businesses listed on this index are mostly young and fast growing. Their earnings, if they have any, will not be generated until some time way into the future.

So how do interest rates impact the valuation of this type of asset? Interest rates determine how much we need to discount cashflows that occur in the future. If interest rates are high, then cashflows that occur years from now are of little value in today’s dollars.

Conversely, if interest rates are ultra low, as they have been over the last year, then there is little difference between the value of a dollar today versus a dollar in the future. This means that as interest rates fall, the current value of the earnings that technology companies can generate in the future become significantly more valuable. This helps to explain the strong performance of the Nasdaq index during 2020.

Investors need to understand the investment regime that they are in as this will have an important outcome on the likely returns. We are of the view that interest rates are not going to continue their 40-year trend ever lower and that they will rise. This means that the investment strategies that have worked for the last 10 years are unlikely to be the home run winners for the next 10 years. Translating this into how we are positioning client portfolios, we see the New Zealand share market as generally expensive and do not expect the same 13%+ per annum returns that it has achieved over the last 10 years. Instead, we are more optimistic towards share markets such as Australia.

Turning to the technology-heavy Nasdaq index, we are of the view that interest rates will be a headwind for the most highly valued companies which are yet to become profitable. However, this does not mean that we are negative on the technology sector in general, as many of the more mature technology companies – such as Amazon, Apple, Adobe and Facebook – generate significant current profits and are much more reasonably valued. Ultimately this is where clients will benefit from the NZ Funds active investment management approach.

Source: Bloomberg, NZ Funds research. Price to earnings ratio.

Source: Bloomberg, NZ Funds research.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

Mark Brooks is Head of Income for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. Mark's comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***

Comments

Post a Comment