Investment Insight | NZ Funds reports exceptional investment performance and discusses its approach

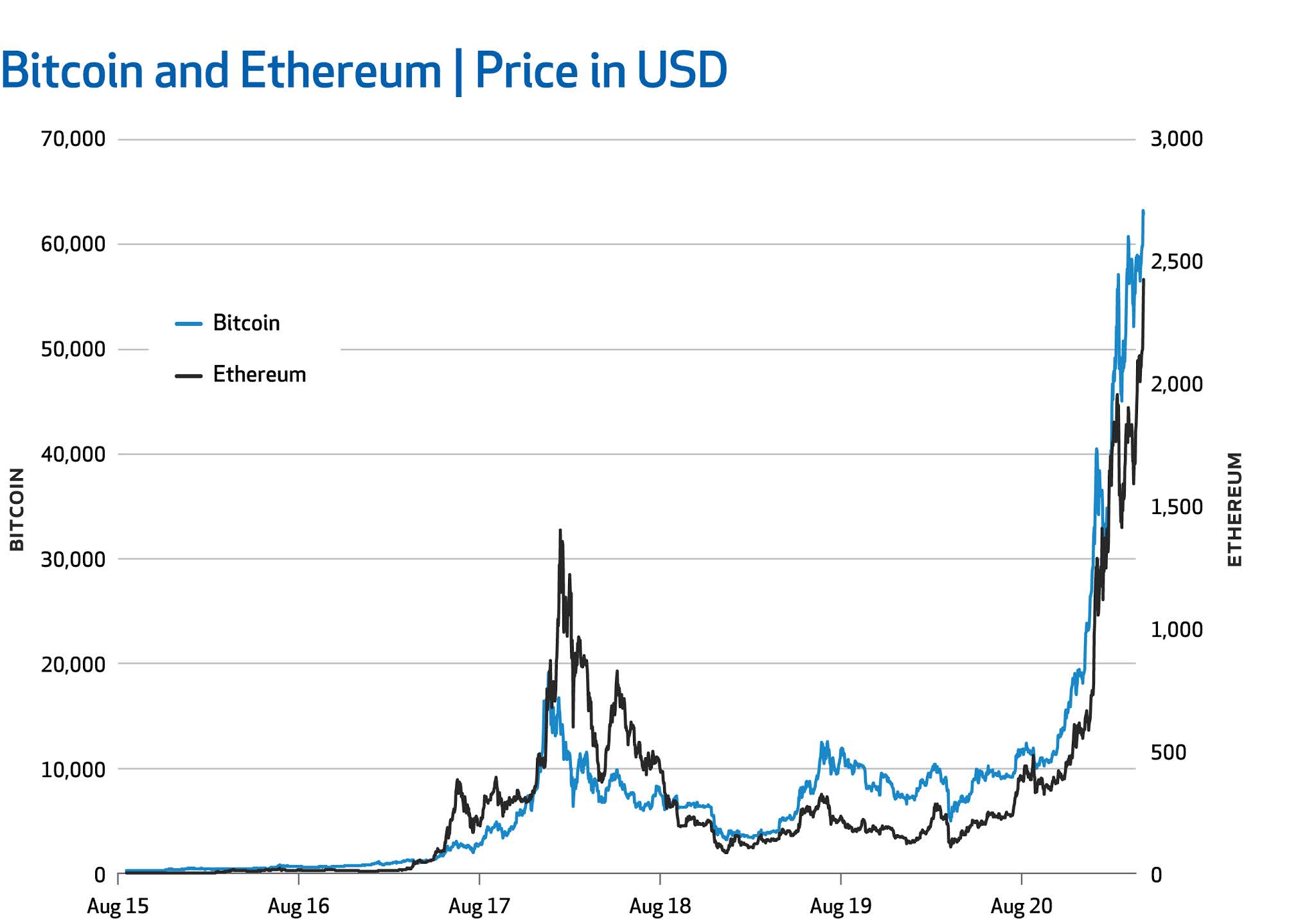

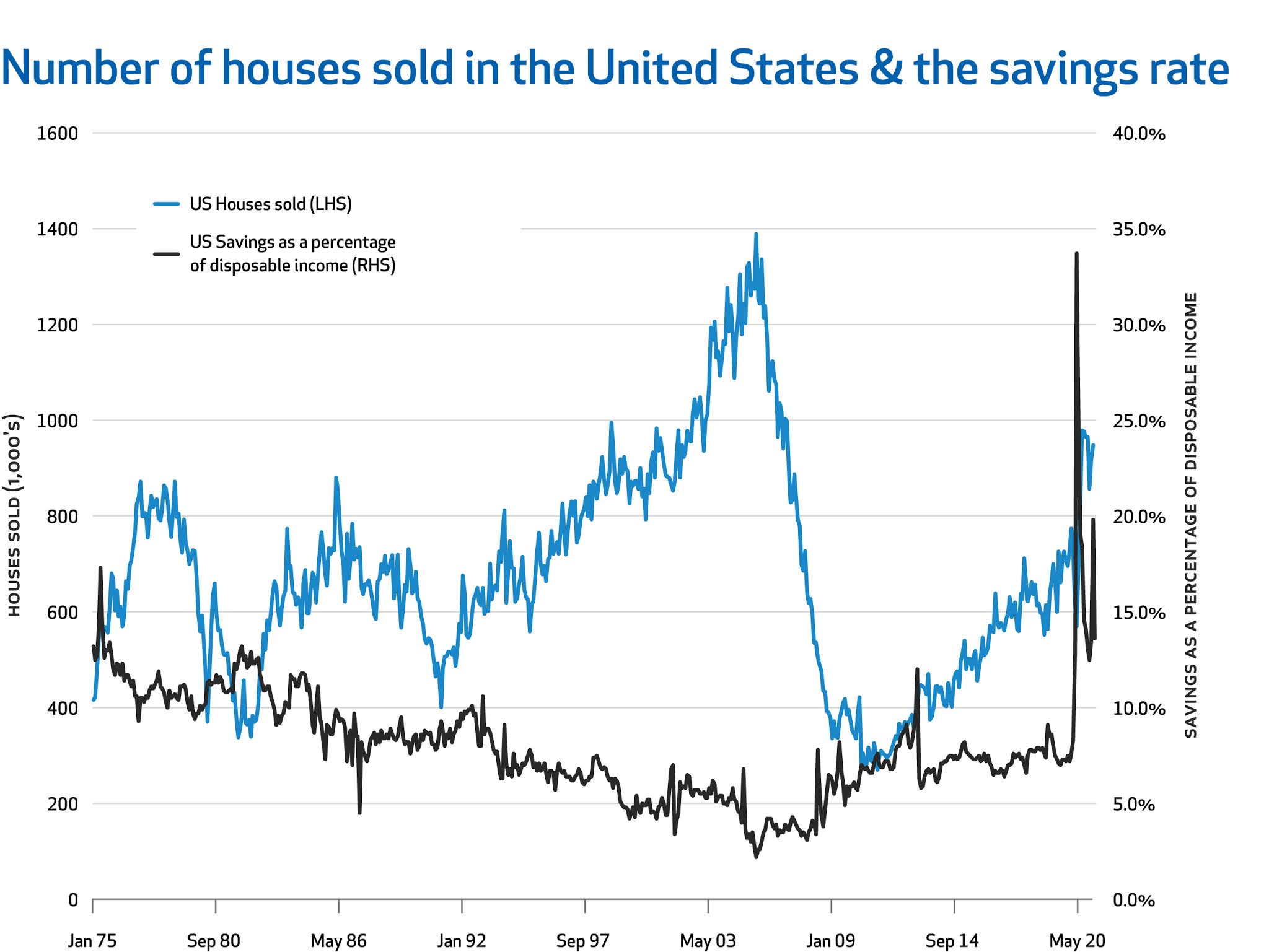

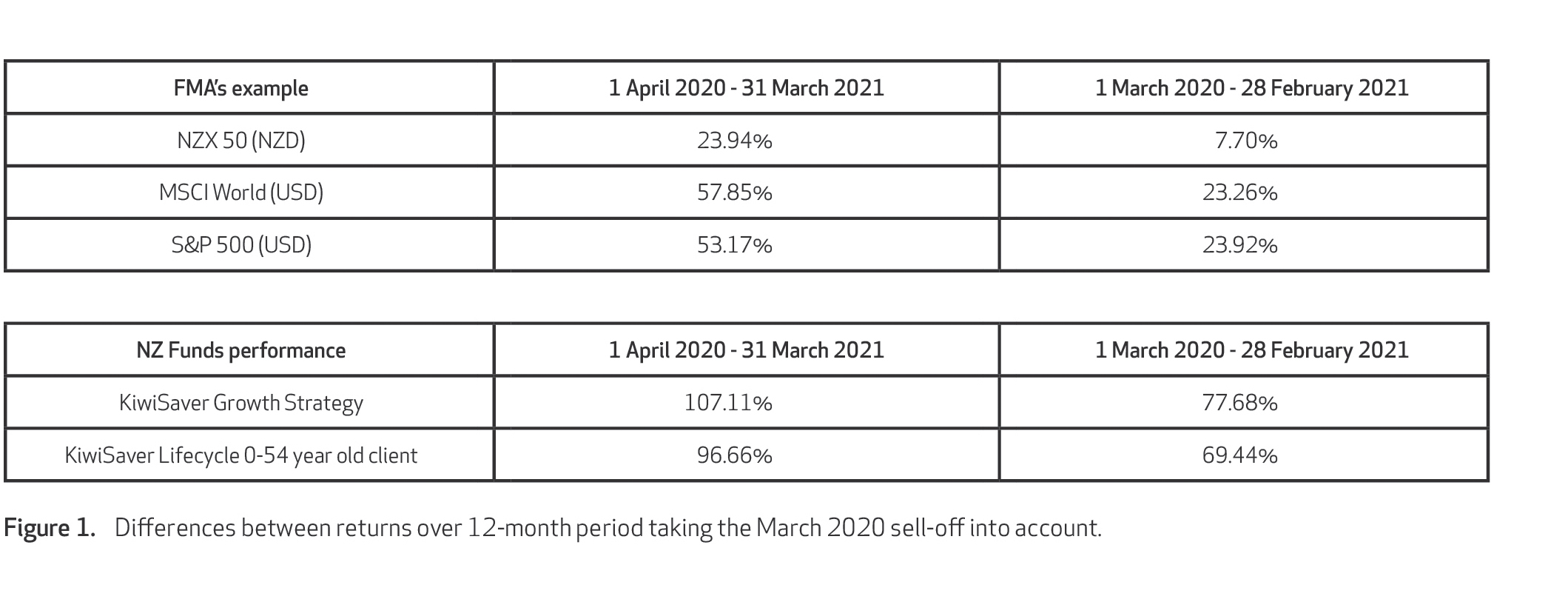

In the 12 months up to 31 March 2021, our KiwiSaver Growth Strategy achieved 107% returns. Over the last three years it returned 25.42% per annum after fees but before tax; and over the last five years 18.85% per annum, making it the top performing KiwiSaver fund in New Zealand for much of that time. To celebrate our 12-month performance and let the public know about it, we booked advertising billboards in Auckland and Wellington. Late last week, the FMA contacted KiwiSaver providers to let them know they were concerned that the advertising of 12-month returns to the end of 31 March 2021 could create a potentially misleading picture in customers’ minds about KiwiSaver performance. This is because we’re now more than a year on from the bottom of the COVID-19 sell-off in March 2020. The sell-off saw dips of 30% or more in market indices around the world, and this was followed by a period of exceptional growth. The reporting and advertising of annual returns has been an industry-