KiwiSaver Insight -

Which KiwiSaver funds will weather the currency war?

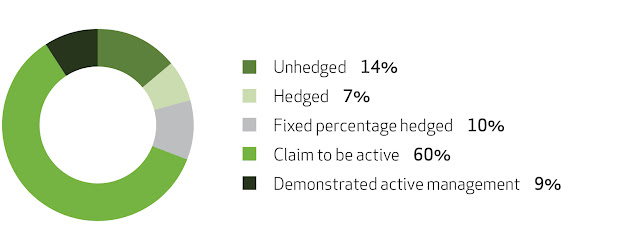

Foreign currency movements have again been in the news with the United States Treasury labelling China a currency manipulator. These movements can also have an impact on clients’ KiwiSaver returns. This is dependent on how a Scheme’s manager treats the foreign currency exposure they get when purchasing international assets. To understand how different KiwiSaver Schemes manage foreign currency within their international share exposure, we reviewed 77 KiwiSaver funds which have an international share exposure of greater than 40%. Information on these funds was sourced from their Fund Updates and their Statement of Investment Policy and Objectives (SIPO). KiwiSaver Scheme managers treat foreign currency exposure in one of four ways. First, they can do nothing and when they purchase international assets, just hold those assets in foreign currency until they are sold. This is what the industry refers to as unhedged international assets. The downside of this approach is evident. If