Investment Insight | Outlook 2022 | Year of the Tiger

As we move on to the final throes of the year the focus across global markets is increasingly on the trade-off between inflation and growth. In this Investment Insight, we outline the key themes that we believe will test markets and drive client portfolios in 2022.

Inflation abounds

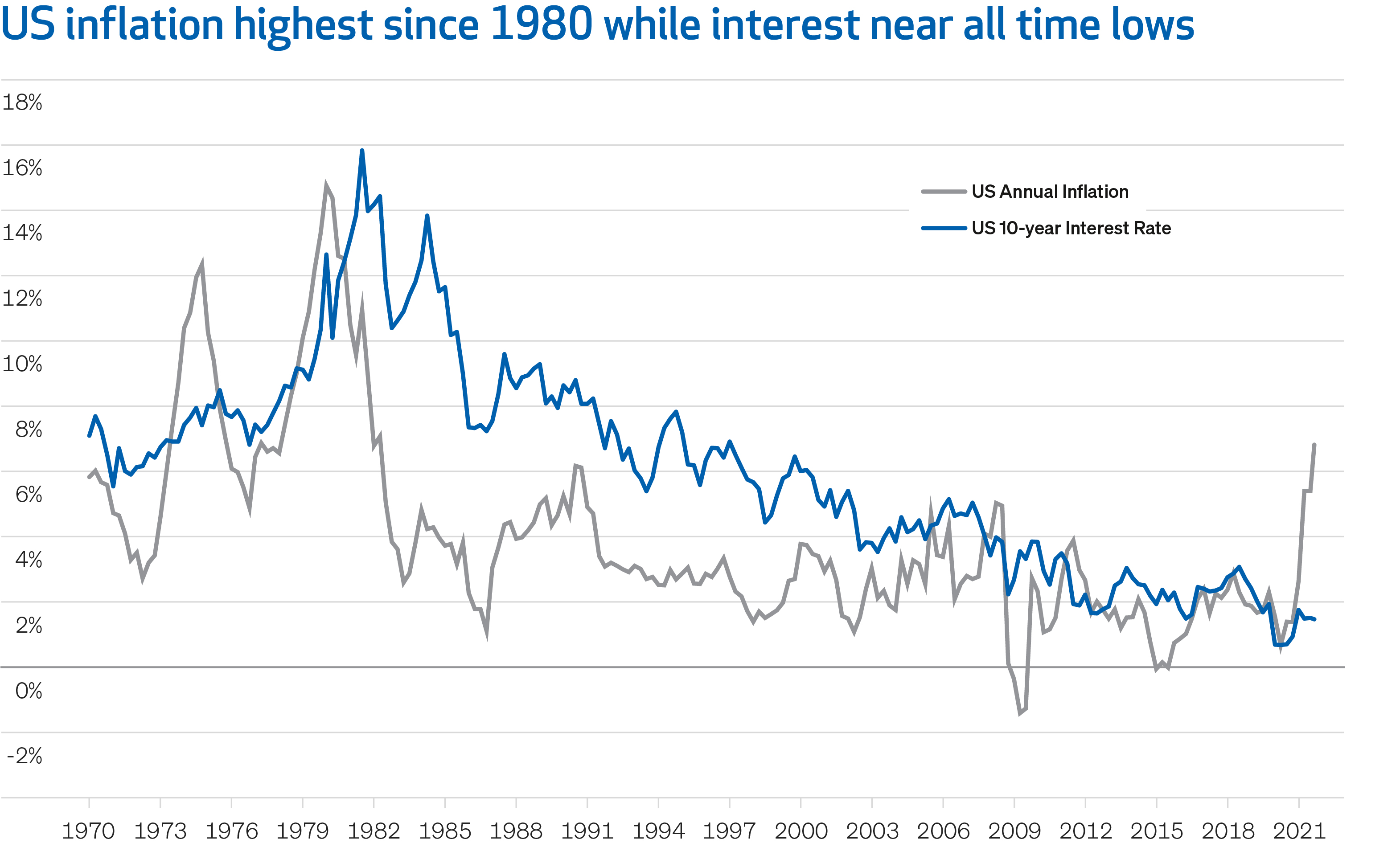

Inflationary pressures remain stickier than many had believed. The United States Consumer Price Index (CPI), a key measure of inflation, rose to 6.8% in November and core CPI increased to 4.9%, a 30-year high.

With inflation clearly more persistent than many had anticipated, a clear theme for 2022 is tightening financial conditions i.e. increasing interest rates. Global financial conditions remain extremely loose. Indeed, higher actual and expected inflation has kept real interest rates in many countries deeply negative. This naturally encourages investors to move further out on the risk spectrum.

This will change in the coming year. Over the last month, the United States Federal Reserve has changed its narrative and market guidance around the path of interest rates with expectations of at least three rate hikes in 2022. This has implications for the valuation of all asset classes.

If we look at past cycles when the Federal Reserve has raised interest rates, it leads to lower future inflation expectations and is very positive for the United States dollar. Importantly, it is a challenging environment for risk assets in general.

Active approach to share markets

Share markets have been in a long-term bull market since the 2007 Global Financial Crisis. This has been driven by favourable economic conditions (particularly in the United States), accommodating monetary policy from central banks and declining interest rates which push asset prices higher.

Even though we saw an economic recession and a bear market in shares due to COVID-19, this was short lived. The bull market continued ferociously on the back of government fiscal stimulus and central banks creating some of the most supportive financial conditions seen in history. This has seen share markets reach valuation levels that have not been seen since the dotcom bubble era of the late 1990s and early 2000s.

The pathway ahead for share markets looks set to be more complex in 2022. We have seen signs of an increase in market uncertainly as we approach year end. Part of this has been the continued new waves of COVID-19, with the latest being the Omicron variant.

More importantly, central banks globally have begun their tightening cycle where they are reducing bond purchases (known as ‘tapering’) and in some cases, such as in New Zealand, have started increasing interest rates. Rising interest rates tend to put pressure on the share prices of many companies. It also gives investors increased incentives to buy bonds, which offer higher yields, and in exchange they sell shares.

Company and sector selection is more important than ever. Rising interest rates combined with inflation impacts companies and sectors to varying degrees. Rising interest rates and high inflation levels are likely to have a significant impact on share market performance.

While the overall markets may perform well, there is likely to be more volatility and uncertainty. Typically, rising interest rates is negative for high growth sectors that have low profits, for example non-profitable technology companies. This is often an environment that favours larger high quality companies with high margins and strong cash flows. Some of the large cap technology companies and healthcare companies are in this bucket.

Commodities and decarbonisation

The market’s focus on COVID-19 and rising interest rates has distracted investor attention away from one of the most dominant themes for global investment markets over the next decade.

Decarbonisation and the focus of achieving net carbon neutral means counties have to meet various carbon emission targets by 2030, 2040 and 2050. This will continue to be an important driver of global investment markets as the implications of decarbonisation stretch throughout the economy.

This includes the rising costs of energy as economies increasingly switch from fossil fuels to cleaner sources of energy. This has a direct impact of increasing the cost of production for goods which is then passed down the supply chain. Furthermore, commodities like copper and aluminium will remain in high demand as they are used heavily in various forms of electrification such as in electric cars.

The pressure from decarbonisation is amplified by the fact that several underlying commodity markets, such as copper, have structural supply issues. Low prices over the last decade have seen little to no new supply come to market and, depending on the commodity, it could be up to 10 years to bring new supply to the market. As a result, the growing demand from decarbonisation is likely to be met by falling availability of supply. This is bullish for prices.

There will be winners and losers. While copper prices may increase, oil and gas companies are now trading at cheap valuations as many investors (including NZ Funds) forego investments in these companies on ESG grounds. Ultimately, declining demand means more investors will forego investment in them. At the same time, sectors such as electric cars, renewable assets, and various metals and minerals such as uranium have strong fundamental tail winds. Over a long-term investment horizon these sectors are likely to outperform.

Digital assets

Despite the pullback recently, 2021 was a momentous year for crypto assets. Bitcoin made strides towards mainstream acceptance with greater institutional investor buy-in as well as major companies like Expedia and Microsoft accepting the coin as a means of exchange.

The year also saw massive growth in Ethereum-based projects such as non-fungible tokens (NFTs). In 2022, Ethereum plans to shift from 'proof of work' to 'proof of stake', which will dramatically alter the landscape for Ethereum-focused miners with better energy efficiency.

In 2022, even more crypto-intensive businesses will go public. We believe that there is a deep pipeline of crypto-enabling companies preparing to go public, and that 2022 will continue the trend set by newly listed companies in 2021. There are a wide range of businesses that crypto companies can participate in – from exchanges to digital asset miners to payment companies.

As the crypto market continues to grow and develop, we anticipate the market to grow with new listings, and also shift as companies win and lose market share.

Looking forward

We believe now may be the best time in recent history to invest with an active approach. A reflation of the global economy - driven by economic stimulus and continued supportive monetary policy – is contributing to greater inflation and interest rate increases. Together with long-term structural changes in digital assets, commodities and infrastructure requirements, clients' portfolios are positioned to take advantage of this rotation.

Inflation abounds

Inflationary pressures remain stickier than many had believed. The United States Consumer Price Index (CPI), a key measure of inflation, rose to 6.8% in November and core CPI increased to 4.9%, a 30-year high.

With inflation clearly more persistent than many had anticipated, a clear theme for 2022 is tightening financial conditions i.e. increasing interest rates. Global financial conditions remain extremely loose. Indeed, higher actual and expected inflation has kept real interest rates in many countries deeply negative. This naturally encourages investors to move further out on the risk spectrum.

This will change in the coming year. Over the last month, the United States Federal Reserve has changed its narrative and market guidance around the path of interest rates with expectations of at least three rate hikes in 2022. This has implications for the valuation of all asset classes.

If we look at past cycles when the Federal Reserve has raised interest rates, it leads to lower future inflation expectations and is very positive for the United States dollar. Importantly, it is a challenging environment for risk assets in general.

Active approach to share markets

Share markets have been in a long-term bull market since the 2007 Global Financial Crisis. This has been driven by favourable economic conditions (particularly in the United States), accommodating monetary policy from central banks and declining interest rates which push asset prices higher.

Even though we saw an economic recession and a bear market in shares due to COVID-19, this was short lived. The bull market continued ferociously on the back of government fiscal stimulus and central banks creating some of the most supportive financial conditions seen in history. This has seen share markets reach valuation levels that have not been seen since the dotcom bubble era of the late 1990s and early 2000s.

The pathway ahead for share markets looks set to be more complex in 2022. We have seen signs of an increase in market uncertainly as we approach year end. Part of this has been the continued new waves of COVID-19, with the latest being the Omicron variant.

More importantly, central banks globally have begun their tightening cycle where they are reducing bond purchases (known as ‘tapering’) and in some cases, such as in New Zealand, have started increasing interest rates. Rising interest rates tend to put pressure on the share prices of many companies. It also gives investors increased incentives to buy bonds, which offer higher yields, and in exchange they sell shares.

Company and sector selection is more important than ever. Rising interest rates combined with inflation impacts companies and sectors to varying degrees. Rising interest rates and high inflation levels are likely to have a significant impact on share market performance.

While the overall markets may perform well, there is likely to be more volatility and uncertainty. Typically, rising interest rates is negative for high growth sectors that have low profits, for example non-profitable technology companies. This is often an environment that favours larger high quality companies with high margins and strong cash flows. Some of the large cap technology companies and healthcare companies are in this bucket.

Commodities and decarbonisation

The market’s focus on COVID-19 and rising interest rates has distracted investor attention away from one of the most dominant themes for global investment markets over the next decade.

Decarbonisation and the focus of achieving net carbon neutral means counties have to meet various carbon emission targets by 2030, 2040 and 2050. This will continue to be an important driver of global investment markets as the implications of decarbonisation stretch throughout the economy.

This includes the rising costs of energy as economies increasingly switch from fossil fuels to cleaner sources of energy. This has a direct impact of increasing the cost of production for goods which is then passed down the supply chain. Furthermore, commodities like copper and aluminium will remain in high demand as they are used heavily in various forms of electrification such as in electric cars.

The pressure from decarbonisation is amplified by the fact that several underlying commodity markets, such as copper, have structural supply issues. Low prices over the last decade have seen little to no new supply come to market and, depending on the commodity, it could be up to 10 years to bring new supply to the market. As a result, the growing demand from decarbonisation is likely to be met by falling availability of supply. This is bullish for prices.

There will be winners and losers. While copper prices may increase, oil and gas companies are now trading at cheap valuations as many investors (including NZ Funds) forego investments in these companies on ESG grounds. Ultimately, declining demand means more investors will forego investment in them. At the same time, sectors such as electric cars, renewable assets, and various metals and minerals such as uranium have strong fundamental tail winds. Over a long-term investment horizon these sectors are likely to outperform.

Digital assets

Despite the pullback recently, 2021 was a momentous year for crypto assets. Bitcoin made strides towards mainstream acceptance with greater institutional investor buy-in as well as major companies like Expedia and Microsoft accepting the coin as a means of exchange.

The year also saw massive growth in Ethereum-based projects such as non-fungible tokens (NFTs). In 2022, Ethereum plans to shift from 'proof of work' to 'proof of stake', which will dramatically alter the landscape for Ethereum-focused miners with better energy efficiency.

In 2022, even more crypto-intensive businesses will go public. We believe that there is a deep pipeline of crypto-enabling companies preparing to go public, and that 2022 will continue the trend set by newly listed companies in 2021. There are a wide range of businesses that crypto companies can participate in – from exchanges to digital asset miners to payment companies.

As the crypto market continues to grow and develop, we anticipate the market to grow with new listings, and also shift as companies win and lose market share.

Looking forward

We believe now may be the best time in recent history to invest with an active approach. A reflation of the global economy - driven by economic stimulus and continued supportive monetary policy – is contributing to greater inflation and interest rate increases. Together with long-term structural changes in digital assets, commodities and infrastructure requirements, clients' portfolios are positioned to take advantage of this rotation.

Source: Bloomberg.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

James Grigor is Chief Investment Officer for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. James' comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***

Comments

Post a Comment