KiwiSaver Insight -

KiwiSaver’s Dark Web

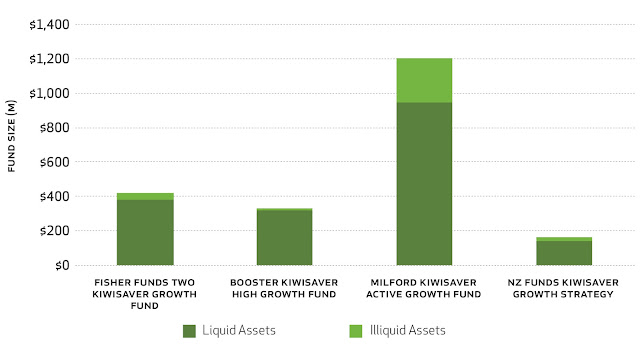

At $55 billion, KiwiSaver is about the size of a third of all shares listed on the NZX. That is big enough to hide a multitude of 'assets'. Like the dark web, you need to dig deeper than the Fund Updates and use forensic expertise to decipher what funds hold, but if you look, this is what you will find. Each KiwiSaver manager is required to calculate an asset liquidity ratio quarterly. The main test of whether an asset is liquid is whether it can be sold in 10 working days at close to its stated value. Illiquid assets are any investment that cannot be sold within that period and private assets, such as unlisted property or private equity. Based on our analysis, as at March 2019 Fisher Funds Two KiwiSaver Growth Fund was an investor in unlisted property, holding 6.62% or $27.8 million. The problem with unlisted property is that there is no arm’s length daily price at which investors can transact. Investors entering and exiting funds which hold illiquid assets are therefor