Investment Insight | Reflation reversal? Thinking long term.

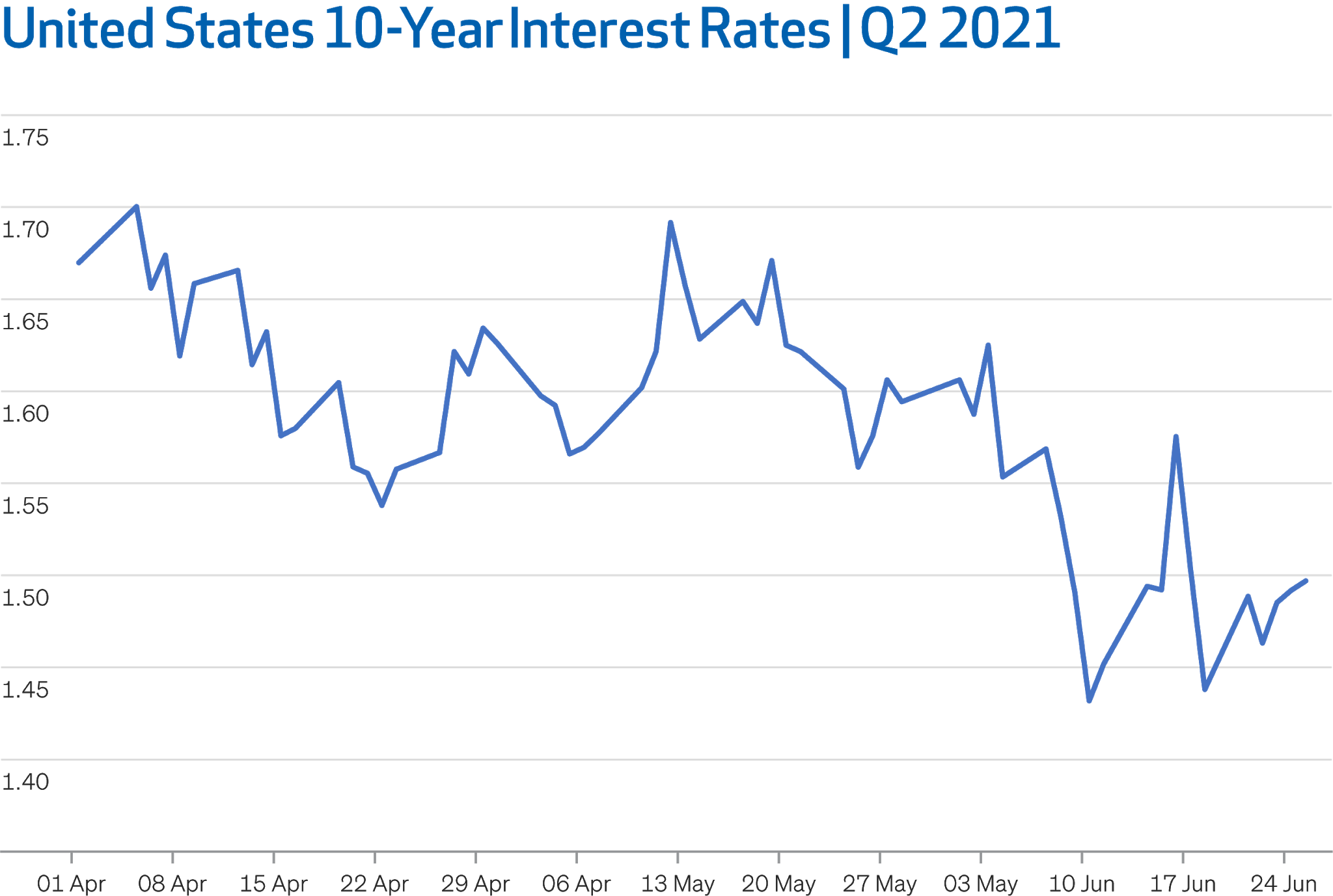

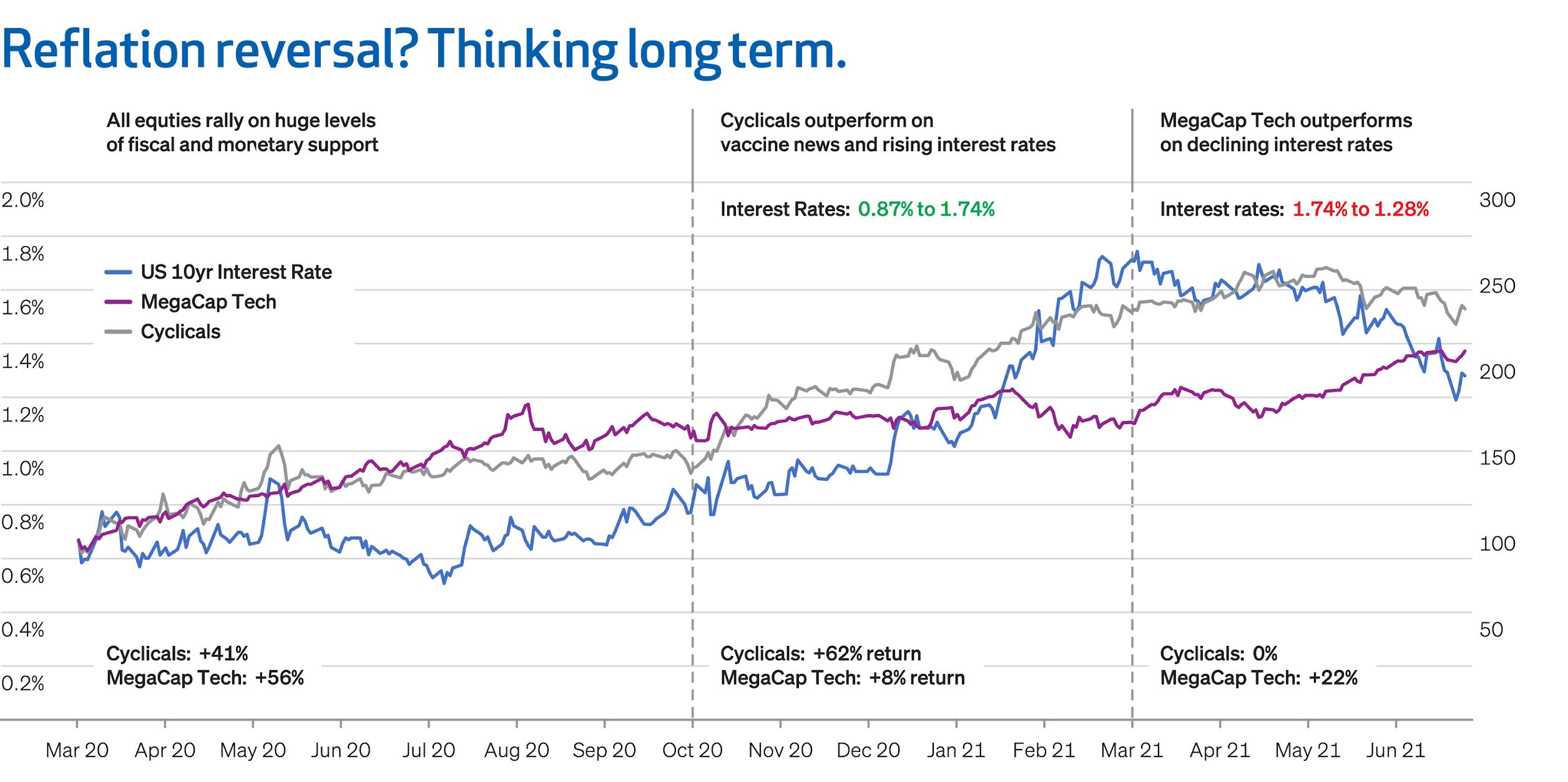

In early June we discussed inflation rising to levels not seen for over 35 years. This ‘reflation’ theme lifted the prices of shares and commodities to record highs. Economically-sensitive shares were good, while bonds, big bond-like shares and those that react strongly to interest rate increases (including technology companies) were bad. Yet for the past few months, the exact opposite has been the case. Since June, investments that benefit from higher inflation made a sudden downturn following the hawkish announcement from the Federal Reserve. Gold and Bitcoin sank, the yield curve flattened aggressively (i.e., interest rates decreased), inflation expectations collapsed, the United States dollar rallied, industrial metal and agricultural commodities plunged, and financial and energy shares underperformed This reflation reversal is the key driver of our underperformance over the past few months. We are disappointed that clients have seen their portfolios reduce in value, especial