Special announcement: COVID-19

Market update 3 - A record of our actions

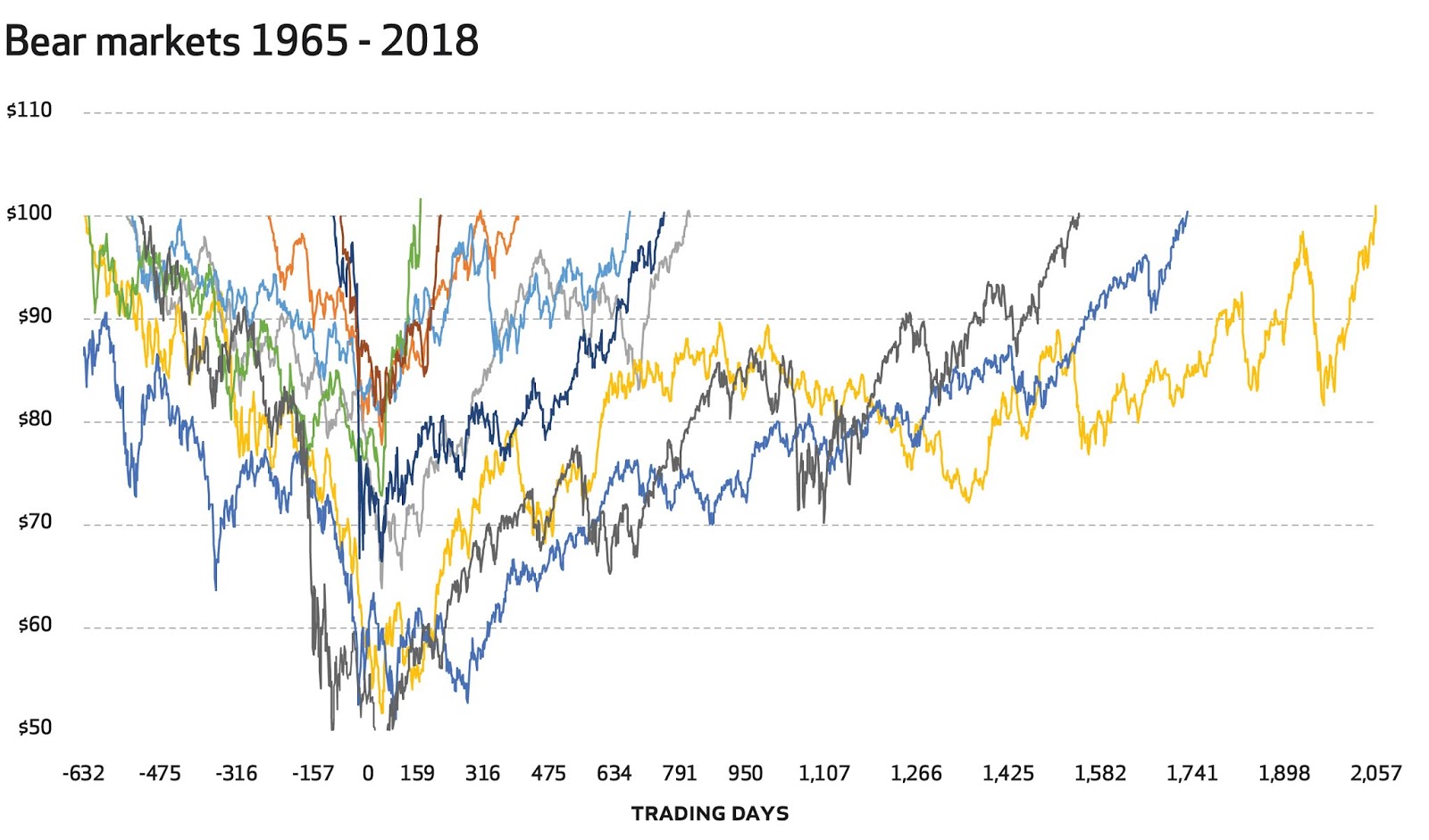

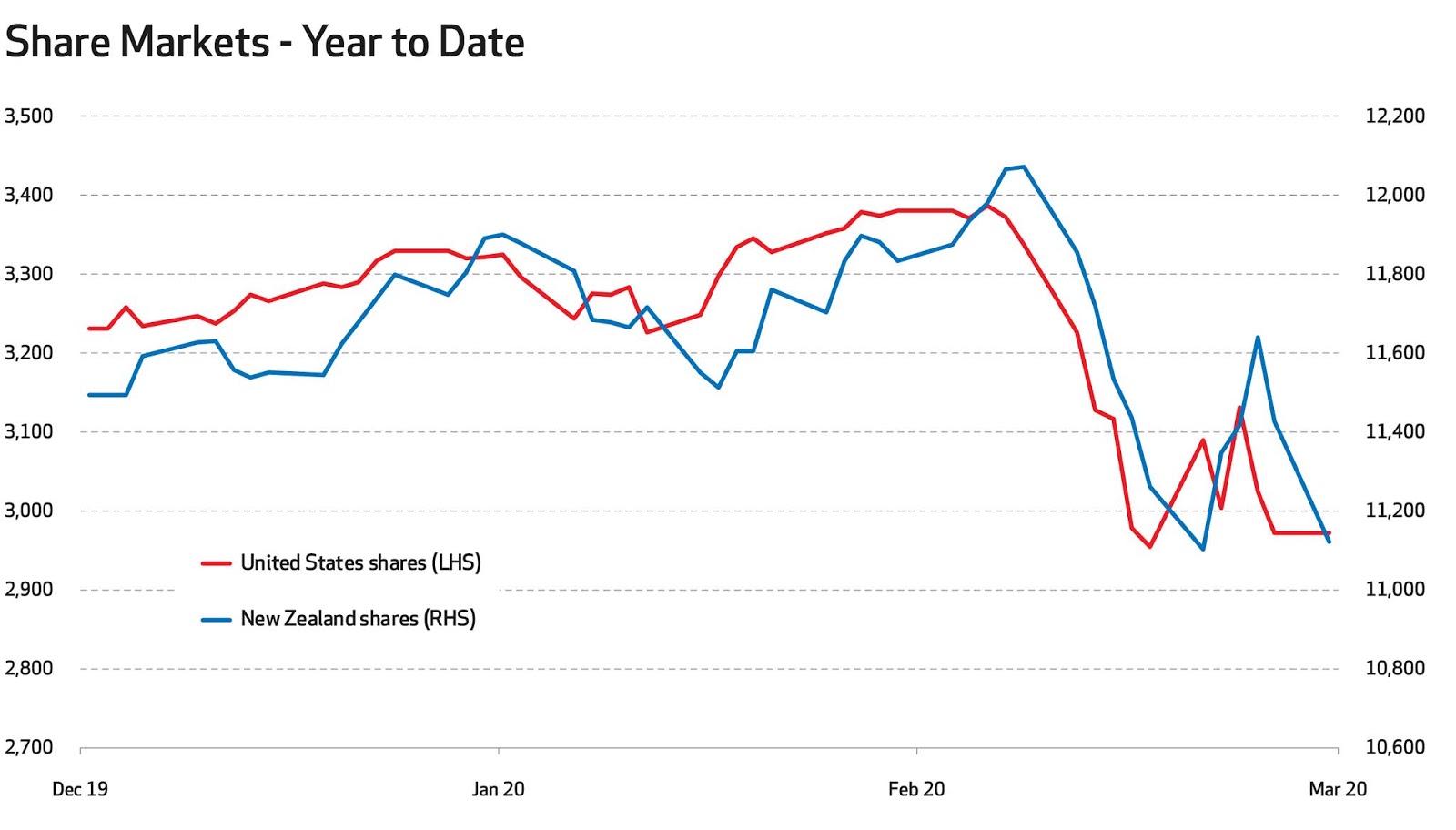

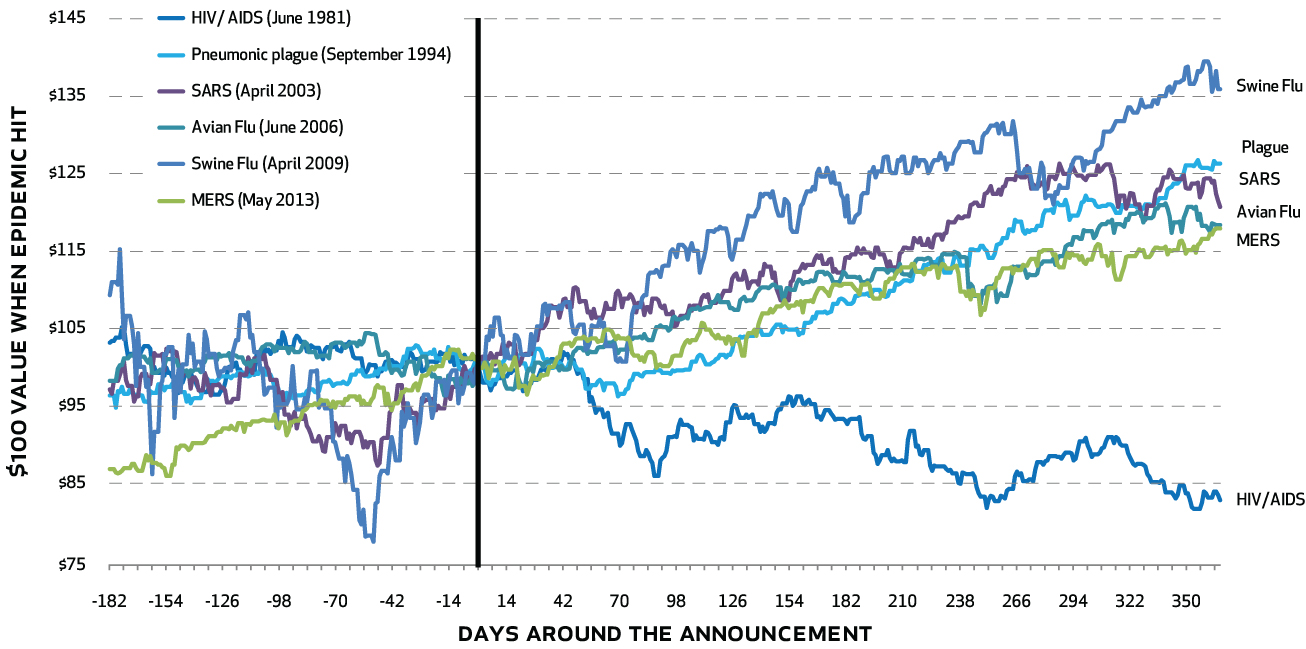

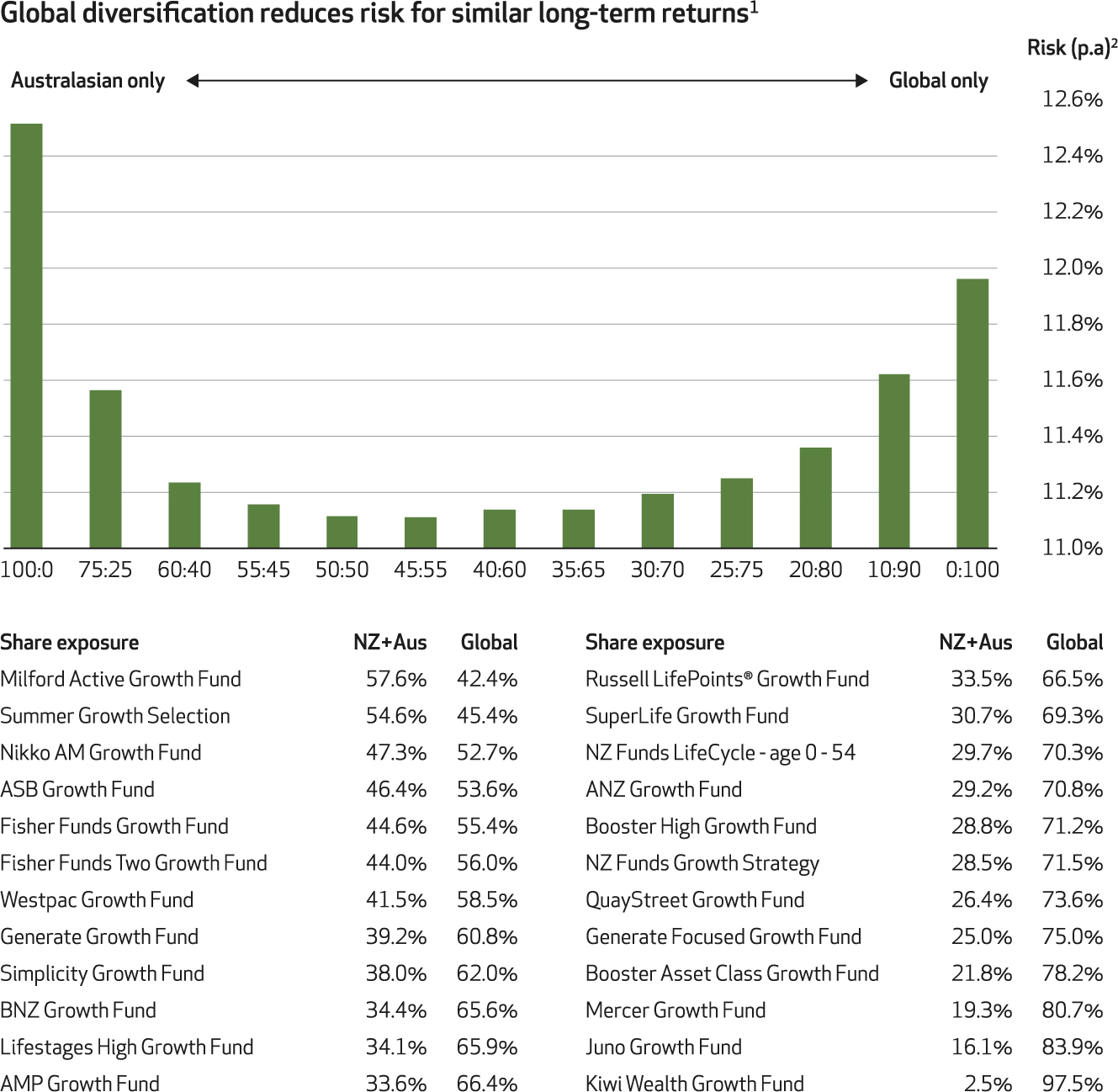

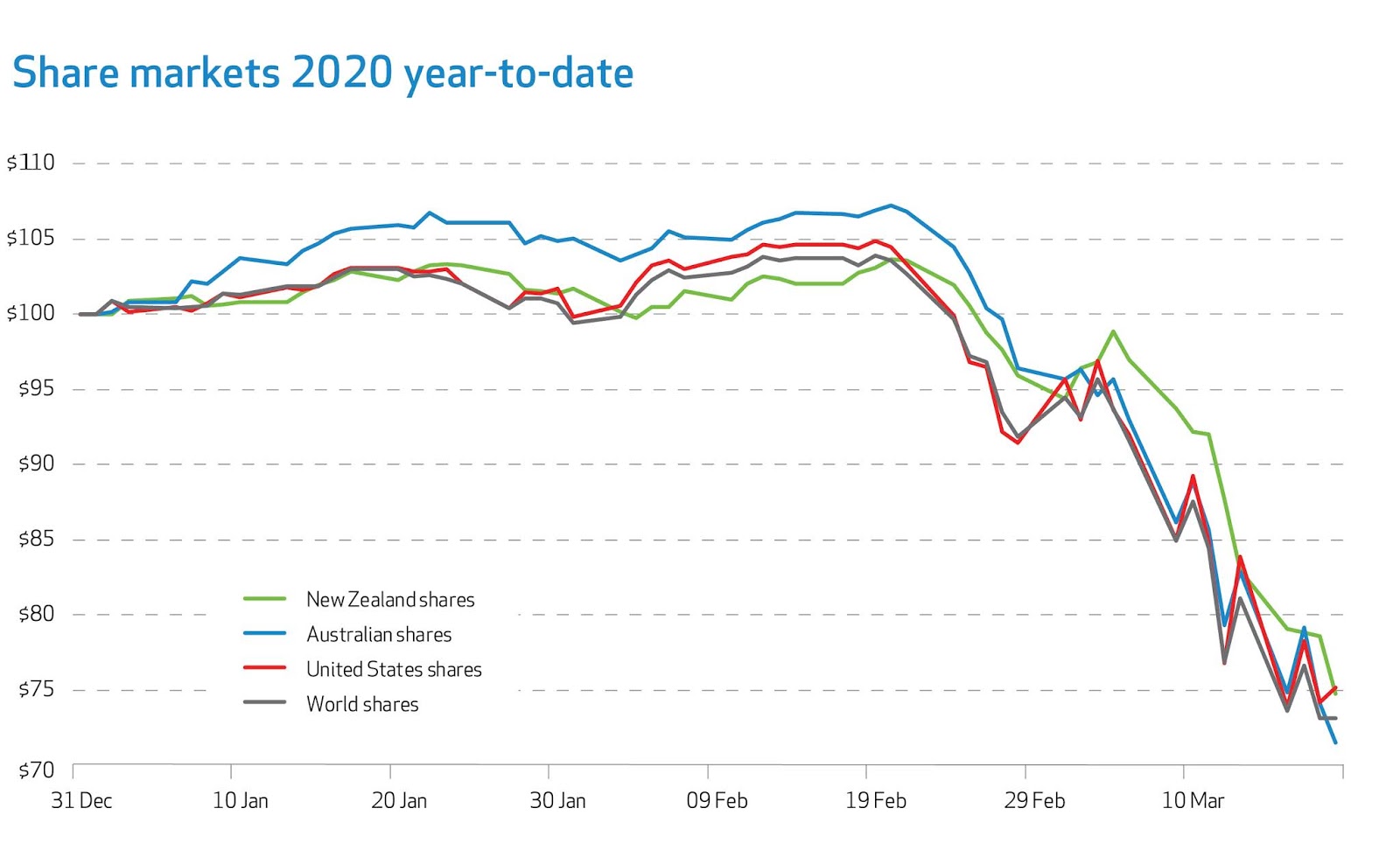

Global share markets have fallen -26.3% year-to-date. United States shares are down -24.9% and Australia and New Zealand shares are down -27.3% and -25.4% respectively. Corporate bonds have also come under pressure and commodity prices continue to collapse, with oil trading at prices not seen since 2003. NZ Funds’ clients have fared much better than the market. The average 45-year old KiwiSaver member is down around -14.0% year-to-date and the average 65-year old KiwiSaver member is estimated to be down only -11.5% year-to-date. Following the share market downturns in 2000 and 2009, NZ Funds developed a strategy with a set of rules and protocols which we would follow in the next major market downturn. In early March NZ Funds implemented this strategy. The following is a record of actions. 10 March 2020 | COVID-19 Special Announcement. Financial markets were struggling to gauge the economic impacts of COVID-19. NZ Funds took steps to mitigate the effect of further financial mar