Investment Insight | Outlook 2022 | Year of the Tiger

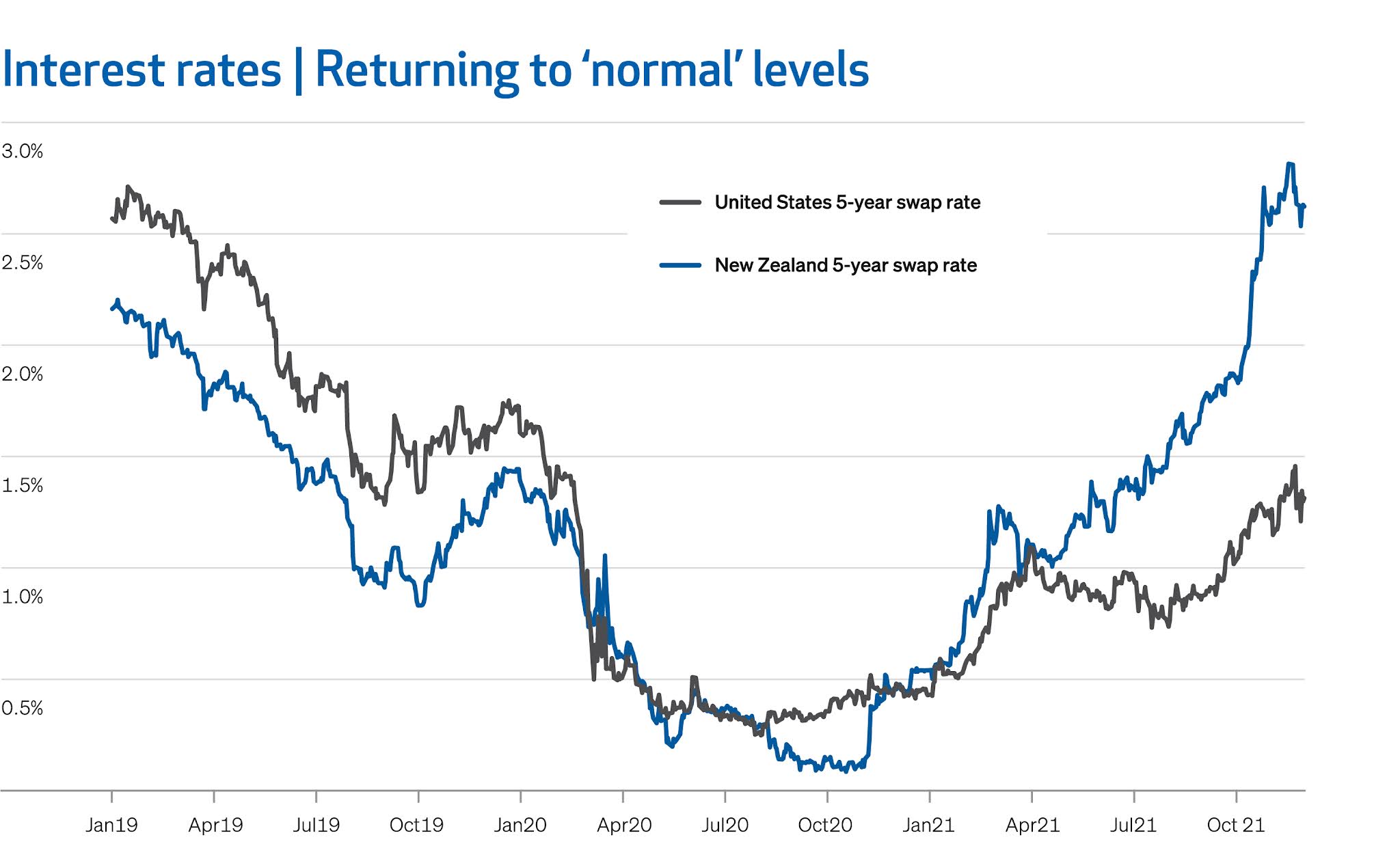

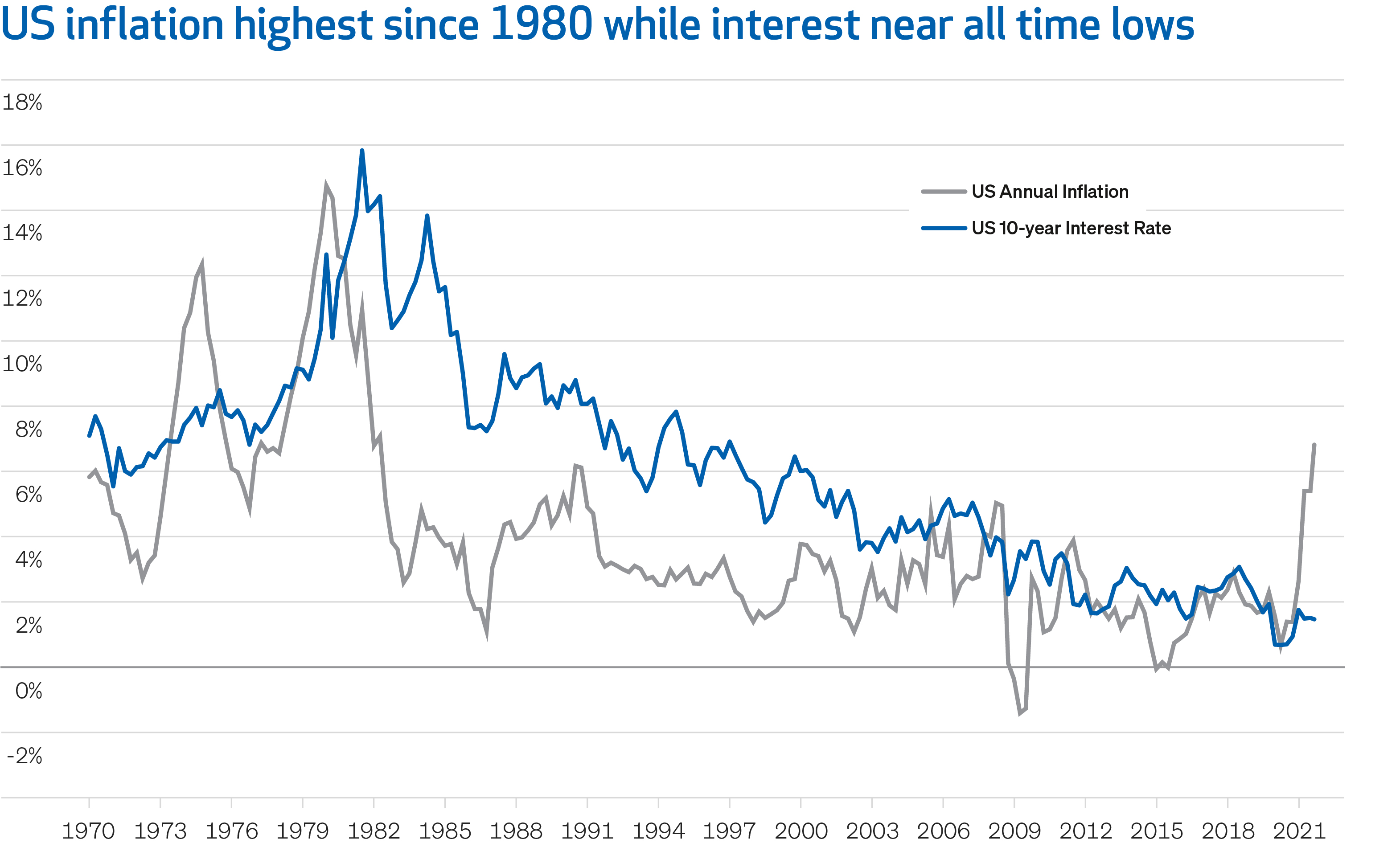

As we move on to the final throes of the year the focus across global markets is increasingly on the trade-off between inflation and growth. In this Investment Insight, we outline the key themes that we believe will test markets and drive client portfolios in 2022. Inflation abounds Inflationary pressures remain stickier than many had believed. The United States Consumer Price Index (CPI), a key measure of inflation, rose to 6.8% in November and core CPI increased to 4.9%, a 30-year high. With inflation clearly more persistent than many had anticipated, a clear theme for 2022 is tightening financial conditions i.e. increasing interest rates. Global financial conditions remain extremely loose. Indeed, higher actual and expected inflation has kept real interest rates in many countries deeply negative. This naturally encourages investors to move further out on the risk spectrum. This will change in the coming year. Over the last month, the United States Federal Reserve has chan