Investment Insight | Global insights shape our investment strategy

Like many industries, investment management is good at using jargon to make things sound more complicated than they are. One such example is ‘mosaic theory’, which refers to a research methodology where the conclusion is arrived at by piecing together many bits of publicly available information. Individually each piece of information may be interesting, but not especially useful - however, when put together, they act like jigsaw pieces revealing the whole picture.

This is one of the strengths of NZ Funds’ approach. We utilise our expertise, diverse experience, and the different asset class focus within our investment team – combined with observations from our international managers (MFS, Fisher Investments, Suvretta and Emersion Point) and our advisory partners – to build a picture of the investment environment.

The emerging picture is that, in our view, the global economy is currently on course for an explosive recovery that has not been seen for many years. Why do we have this view? This picture has been pieced together from a wide range of diverse information sources telling us that the global economic recovery in 2021 will be very different from the slow recovery experienced following the Global Financial Crisis.

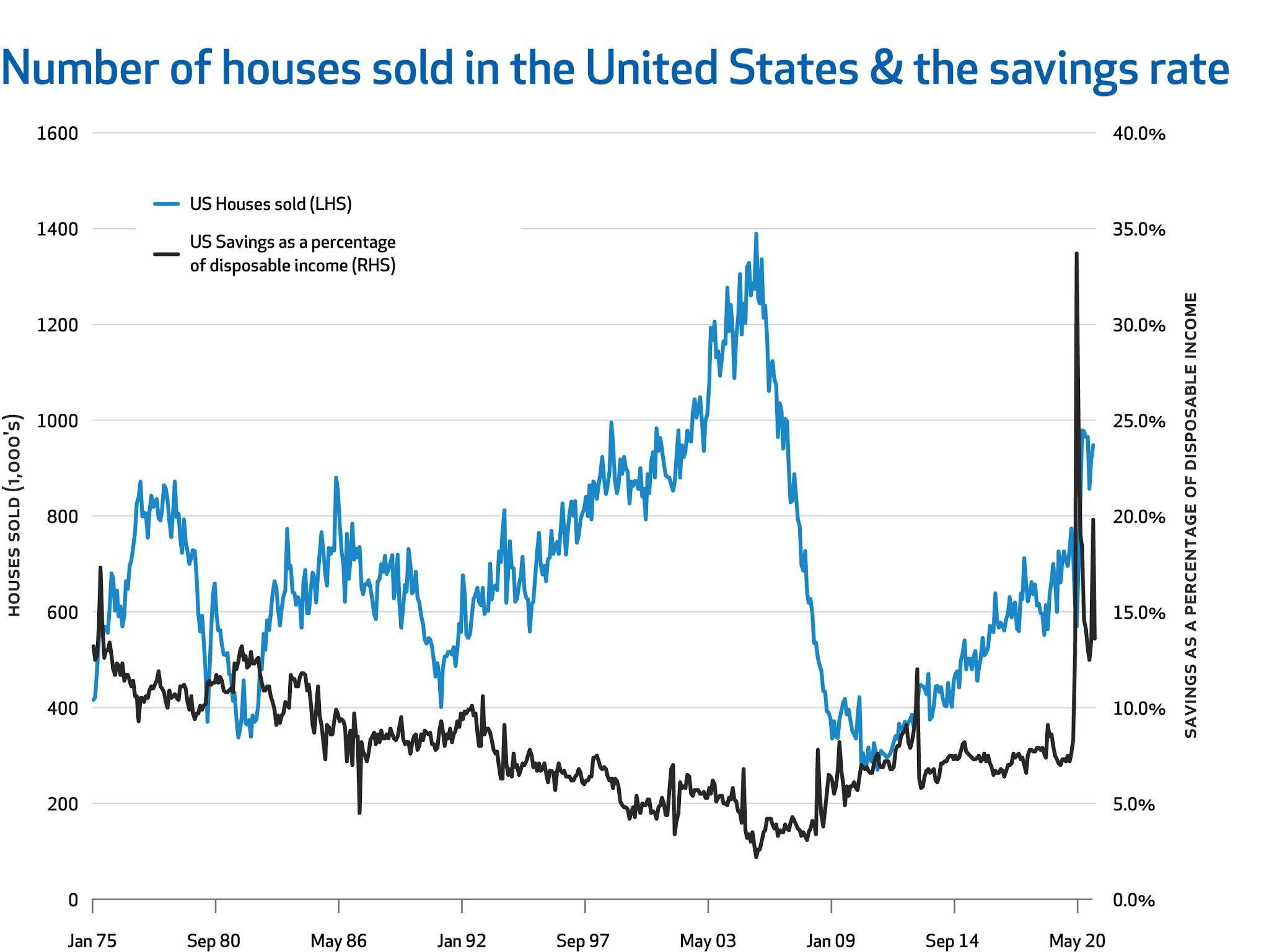

House prices are booming around the world. It is common knowledge that New Zealand house prices have risen substantially. This is also occurring in Australia, the United States, Israel and (to a lesser degree) the United Kingdom. Israel is an interesting test case as it has the highest COVID-19 vaccination rate of any country and has seen the number of house sales ramp up steadily as vaccination uptake in that country has increased.

We also know from academic studies that the housing sector has an impact on economic activity that is far greater than just the direct dollars spent. A 2020 Australian study1 found that the residential building industry had the second largest multiple of all 114 industries making up the Australian economy. The same analysis found that every $1 million of construction supports $2.9 million of output and consumption across the economy.

Other economic data points suggest that consumers have both the ability and the willingness to spend. The personal savings rate in the United States is currently around 13%. Outside of a spike at the start of the pandemic, this is a level last seen in 1975. This savings rate is reflected in the holdings of money market funds. Despite interest rates being close to zero, total assets under management have increased from $4 trillion at end of 2019 to $4.86 trillion today, an increase of 21%. It is also reflected in the level of credit card debt; in total, Americans repaid $83 billion in credit card debt during 2020. This is only the second time in 35 years that there has been a year-on-year decline.

Consumers have the ability to spend but do they have the confidence to spend? Here we can look to survey data on consumer confidence and job openings. The US Conference Board Consumer Confidence Survey for March 2021 recorded its largest monthly gain in 18 years. Similarly, despite unemployment remaining relatively high, job postings are now 13% above pre-pandemic levels. This helps us build a pattern of optimism regarding future intentions.

Finally, there is the issue of FOMO ('fear of missing out'). There has been talk in the media of pending price rises and supply issues for many consumer goods. Events such as the recently resolved blockage in the Suez Canal will further disrupt supply chains. Meanwhile, the US auto industry has asked the government for help as a result of the global semiconductor shortage. A combination of consumers with money in their pockets and potential product shortages creates an inducement to purchase now rather than think it over.

For the last decade, China has been exporting deflation to the world, thanks to production of ever-cheaper products. However, the reverse is now happening – Chinese producers are increasing the prices on the goods they sell overseas and domestically, due to higher raw material costs and shipping costs that are as much as 300% above pre-pandemic levels.

In summary, factors as disparate as house prices in Tel Aviv, an Australian government academic study, money market holdings, a shortage of computer chips, and consumer survey data can coalesce – much like one of those 'magic-eye' 3D pictures – to produce a detailed picture of the path ahead. In times of major change, having a global view and being able to draw on the insights of our international partners is a key strength of the NZ Funds investment process and something that distinguishes the investment solution we are bringing to our clients from those of our competitors.

1. 'Building Jobs: How Residential Construction Drives the Economy', Australian Housing Finance and Investment Corporation, June 2020

This is one of the strengths of NZ Funds’ approach. We utilise our expertise, diverse experience, and the different asset class focus within our investment team – combined with observations from our international managers (MFS, Fisher Investments, Suvretta and Emersion Point) and our advisory partners – to build a picture of the investment environment.

The emerging picture is that, in our view, the global economy is currently on course for an explosive recovery that has not been seen for many years. Why do we have this view? This picture has been pieced together from a wide range of diverse information sources telling us that the global economic recovery in 2021 will be very different from the slow recovery experienced following the Global Financial Crisis.

House prices are booming around the world. It is common knowledge that New Zealand house prices have risen substantially. This is also occurring in Australia, the United States, Israel and (to a lesser degree) the United Kingdom. Israel is an interesting test case as it has the highest COVID-19 vaccination rate of any country and has seen the number of house sales ramp up steadily as vaccination uptake in that country has increased.

We also know from academic studies that the housing sector has an impact on economic activity that is far greater than just the direct dollars spent. A 2020 Australian study1 found that the residential building industry had the second largest multiple of all 114 industries making up the Australian economy. The same analysis found that every $1 million of construction supports $2.9 million of output and consumption across the economy.

Other economic data points suggest that consumers have both the ability and the willingness to spend. The personal savings rate in the United States is currently around 13%. Outside of a spike at the start of the pandemic, this is a level last seen in 1975. This savings rate is reflected in the holdings of money market funds. Despite interest rates being close to zero, total assets under management have increased from $4 trillion at end of 2019 to $4.86 trillion today, an increase of 21%. It is also reflected in the level of credit card debt; in total, Americans repaid $83 billion in credit card debt during 2020. This is only the second time in 35 years that there has been a year-on-year decline.

Consumers have the ability to spend but do they have the confidence to spend? Here we can look to survey data on consumer confidence and job openings. The US Conference Board Consumer Confidence Survey for March 2021 recorded its largest monthly gain in 18 years. Similarly, despite unemployment remaining relatively high, job postings are now 13% above pre-pandemic levels. This helps us build a pattern of optimism regarding future intentions.

Finally, there is the issue of FOMO ('fear of missing out'). There has been talk in the media of pending price rises and supply issues for many consumer goods. Events such as the recently resolved blockage in the Suez Canal will further disrupt supply chains. Meanwhile, the US auto industry has asked the government for help as a result of the global semiconductor shortage. A combination of consumers with money in their pockets and potential product shortages creates an inducement to purchase now rather than think it over.

For the last decade, China has been exporting deflation to the world, thanks to production of ever-cheaper products. However, the reverse is now happening – Chinese producers are increasing the prices on the goods they sell overseas and domestically, due to higher raw material costs and shipping costs that are as much as 300% above pre-pandemic levels.

In summary, factors as disparate as house prices in Tel Aviv, an Australian government academic study, money market holdings, a shortage of computer chips, and consumer survey data can coalesce – much like one of those 'magic-eye' 3D pictures – to produce a detailed picture of the path ahead. In times of major change, having a global view and being able to draw on the insights of our international partners is a key strength of the NZ Funds investment process and something that distinguishes the investment solution we are bringing to our clients from those of our competitors.

1. 'Building Jobs: How Residential Construction Drives the Economy', Australian Housing Finance and Investment Corporation, June 2020

Source: Bloomberg, NZ Funds calculations

For more information please contact NZ Funds.

For more information please contact NZ Funds.

Source: Bloomberg, NZ Funds calculations

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

Mark Brooks is Head of Income for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. Mark's comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***

Comments

Post a Comment