Investment Insight |

China encouraging equity ownership

Over the last decade the performance of the United States share market has significantly overshadowed other major markets. This is in large part due to the success of the technology related companies which have made up a larger percentage of the market in the United States compared to other markets.

However, this may not be the case over the next decade as other markets around the world have some potential. One candidate for outperformance is the Chinese share market. The Chinese government is making significant moves to migrate household assets, predominantly held in real estate, into financial assets such as shares.

During the last week of October, the Chinese Communist Party will meet to set the blueprint for the five-year plan for 2021-2025. The message from this meeting will be that the external environment is likely to get more challenging for China in the next five years. On the economic front, global growth is expected to be lower in the coming years and trade protectionism, which has increased in recent years, will continue to be an issue. To counter this, China needs to emphasise a new pattern of development which is more self-sufficient and takes their domestic market as the mainstay.

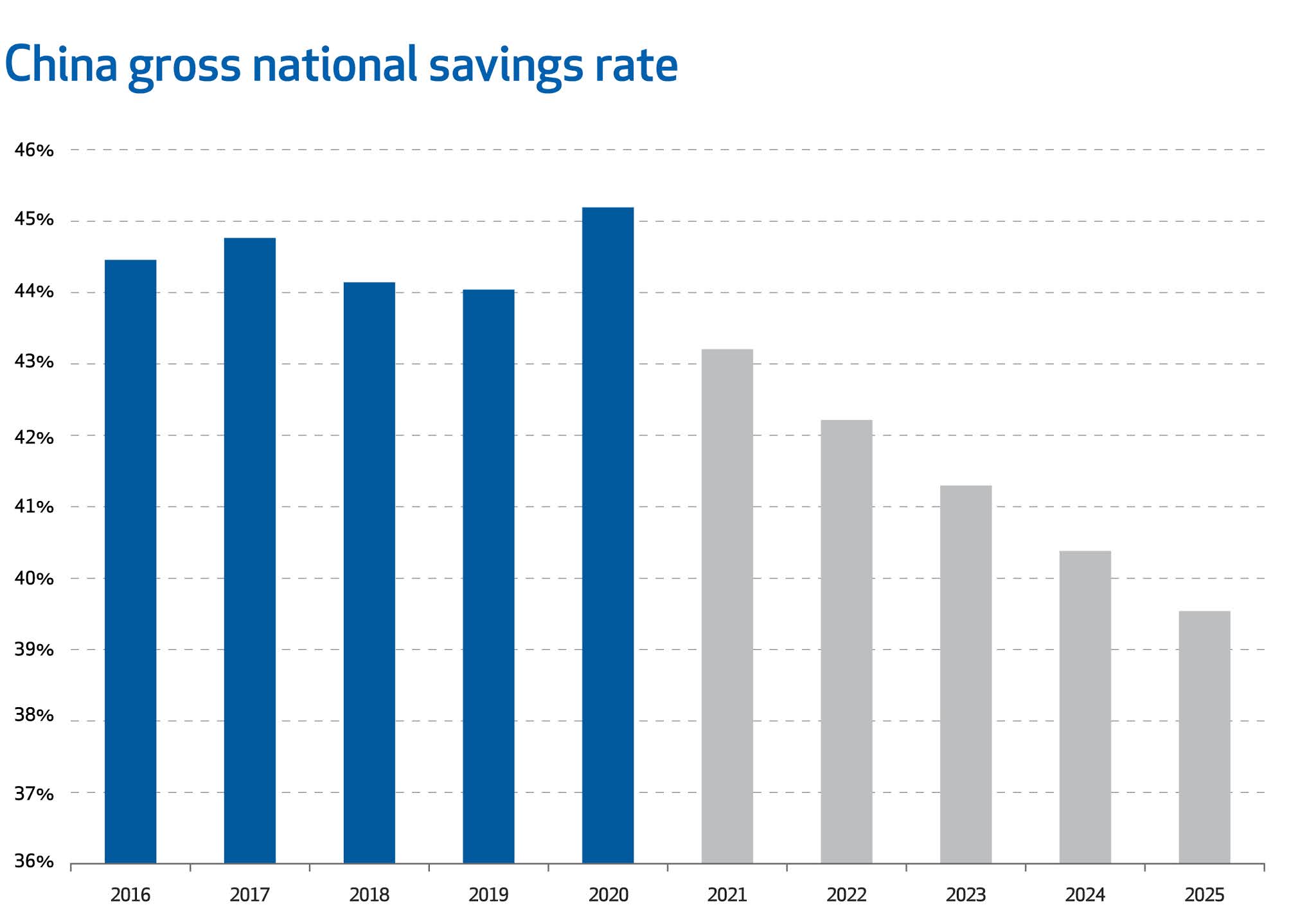

This domestic focus is the next step in a process that started three years ago with President Xi's moves to deleverage and strengthen the financial sector. As part of this, shadow bank lending and online borrowing platforms that many households had come to depend upon, were severely curtailed. The result was a sharp increase in the savings rate of Chinese households - since 2018 precautionary savings have increased by 90%. China now has structurally high household savings rates, with gross savings currently 45% of GDP, 10% above Korea and more than 25% above western norms.

China's leadership wants to utilise these savings in two ways. First, they want to incentivise domestic consumption. This has been outlined in the "Dual Circulation" plan to drive growth through innovation and high-quality domestic demand. This "circulation" means ensuring the smooth and "safe" operation of supply chains, production, logistics, sales and consumption.

Second, they want to encourage a move away from real estate as the primary savings/risky asset for households. This is summed up by the phrase "housing is for living, not speculation". This is an evolution from the deleveraging initiative that was executed for the financial sector, because policymakers see real estate as one of the highest risk economic sectors. Chinese residential real estate development is a huge market and deposits alone can be upwards of US$800 billion per year. If even 5-10% of this capital was freed up, it would release a considerable sum into the economy each year for investment and discretionary consumption. If the primary risky asset for a household is no longer their house, then their investments will find a home in financial assets.

The last part of this puzzle is capital market reform to ensure that China's share markets are attractive for both investors and companies, and to migrate China's financing model from a bank centric credit model to one that is more focused on 'direct financing', which is essentially equity. The reform includes the establishment of the Star Market, a Nasdaq-style technology focused market for Chinese tech companies. The listing process is being simplified and standardised to make it easier and faster for companies to list in China. For investors, these reforms also strengthen the availability of information, with requirements for more transparent and comprehensive disclosure, including environmental, social and governance issues.

NZ Funds sees the combination of political intent and significant capital creating a structural bull case for Chinese shares, and we are adding to positions so that clients can participate in this.

However, this may not be the case over the next decade as other markets around the world have some potential. One candidate for outperformance is the Chinese share market. The Chinese government is making significant moves to migrate household assets, predominantly held in real estate, into financial assets such as shares.

During the last week of October, the Chinese Communist Party will meet to set the blueprint for the five-year plan for 2021-2025. The message from this meeting will be that the external environment is likely to get more challenging for China in the next five years. On the economic front, global growth is expected to be lower in the coming years and trade protectionism, which has increased in recent years, will continue to be an issue. To counter this, China needs to emphasise a new pattern of development which is more self-sufficient and takes their domestic market as the mainstay.

This domestic focus is the next step in a process that started three years ago with President Xi's moves to deleverage and strengthen the financial sector. As part of this, shadow bank lending and online borrowing platforms that many households had come to depend upon, were severely curtailed. The result was a sharp increase in the savings rate of Chinese households - since 2018 precautionary savings have increased by 90%. China now has structurally high household savings rates, with gross savings currently 45% of GDP, 10% above Korea and more than 25% above western norms.

China's leadership wants to utilise these savings in two ways. First, they want to incentivise domestic consumption. This has been outlined in the "Dual Circulation" plan to drive growth through innovation and high-quality domestic demand. This "circulation" means ensuring the smooth and "safe" operation of supply chains, production, logistics, sales and consumption.

Second, they want to encourage a move away from real estate as the primary savings/risky asset for households. This is summed up by the phrase "housing is for living, not speculation". This is an evolution from the deleveraging initiative that was executed for the financial sector, because policymakers see real estate as one of the highest risk economic sectors. Chinese residential real estate development is a huge market and deposits alone can be upwards of US$800 billion per year. If even 5-10% of this capital was freed up, it would release a considerable sum into the economy each year for investment and discretionary consumption. If the primary risky asset for a household is no longer their house, then their investments will find a home in financial assets.

The last part of this puzzle is capital market reform to ensure that China's share markets are attractive for both investors and companies, and to migrate China's financing model from a bank centric credit model to one that is more focused on 'direct financing', which is essentially equity. The reform includes the establishment of the Star Market, a Nasdaq-style technology focused market for Chinese tech companies. The listing process is being simplified and standardised to make it easier and faster for companies to list in China. For investors, these reforms also strengthen the availability of information, with requirements for more transparent and comprehensive disclosure, including environmental, social and governance issues.

NZ Funds sees the combination of political intent and significant capital creating a structural bull case for Chinese shares, and we are adding to positions so that clients can participate in this.

Source: IMF World Economic Outlook

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

Mark Brooks is Head of Income for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. Mark's comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***

Comments

Post a Comment