Investment Insights -

United States - China relations | Cold War II?

What is now commonly dubbed the ‘United States - China trade war’ is a series of tariff-imposition threats and actions started by the United States against China at the beginning of 2018 and responded to by way of similar retaliatory measures by China.

At the root of the ongoing trade dispute is a disagreement over technology. The United States believes that the subsidies China offers its tech sector provide those firms with an unfair advantage over United States tech companies. Overlaying the issue of ‘fairness’ is a concern that Chinese technology could threaten United States’ national security. China denies any security threat and is reluctant to abandon the support it provides its own tech companies.

Tariffs imposed by the United States are at the centre of the trade war, but are unlikely to be fatal for global growth. The United States exports 0.6% of its GDP to China. China has more at stake given it exports 3.6% of its GDP to the United States. However, even after the current geopolitical escalation, the direct effects at this stage are relatively small.

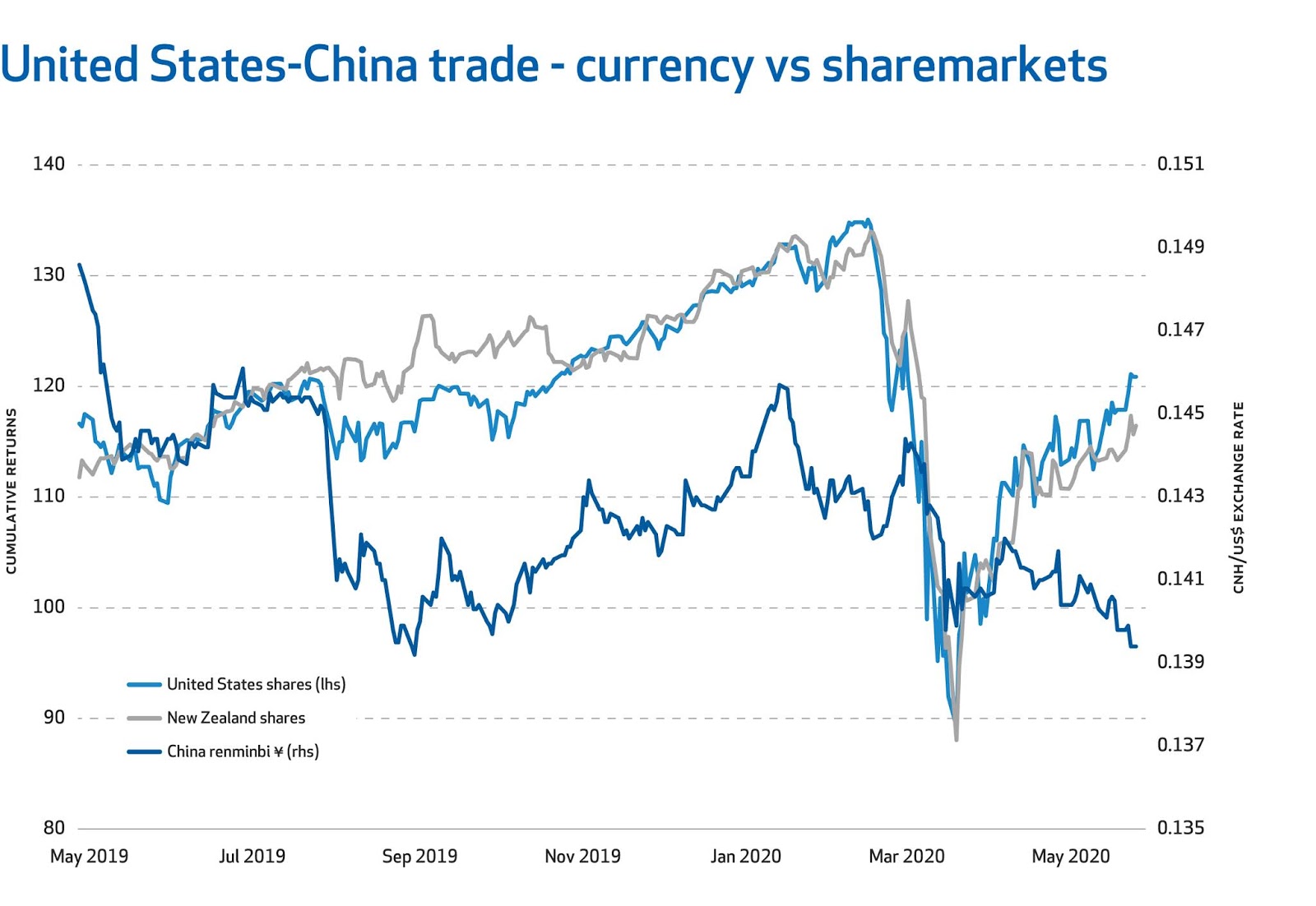

Although this conflict between the United States and China will create share market volatility, we remain positive that share markets will continue to push higher. Our optimism comes from the deluge of COVID-19-induced stimulus measures as governments and central banks prop up the global economy. This stimulus feeds through into a positive, albeit volatile, outlook for financial markets.

While share markets might shrug off much of the effect of a trade war, it is in currency markets where we expect the tension to play out. China’s currency fell in the wake of its plans to impose a sweeping national security law on Hong Kong. The renminbi weakened versus the United States dollar to the lowest level since September 2019. Allowing the currency to weaken helps China offset the impact of United States’ tariffs on its products.

NZ Funds’ positioning

An escalating trade war between the United States and China may push the New Zealand and Australian share markets lower due to their vulnerability to global trade. We wrote in 15 May 2020 | Home market bias that the dividend yields offered by New Zealand shares makes them more attractive than ever. NZ Funds’ dividend-focused approach to selecting shares is an ideal strategy for the current environment.

Therefore, we remain fully invested in the New Zealand share market. However, external influences mean we also retain diversification across global share markets, including the United States, Europe, Japan, China and Australia.

We are again witnessing geopolitical events influencing financial markets which until now have been dominated by the effects of COVID-19. We remain positive on shares and continue to expect the purchases we make today will deliver significant capital gains over the next two to three years.

We have hedged against the effect of the trade war to protect our Australian and New Zealand shares, which are potentially at risk from increased trade tensions. As a result, clients’ portfolios are in a position to profit from any weakness in China’s currency.

The trade war means both the United States and China may each further increase their stimulus packages to protect their respective economies from the fall out. Continued stimulus has long-term implications for inflation and, with interest rates likely to remain close to zero for some time to come, we retain a moderate position in gold for our clients.

At the root of the ongoing trade dispute is a disagreement over technology. The United States believes that the subsidies China offers its tech sector provide those firms with an unfair advantage over United States tech companies. Overlaying the issue of ‘fairness’ is a concern that Chinese technology could threaten United States’ national security. China denies any security threat and is reluctant to abandon the support it provides its own tech companies.

Tariffs imposed by the United States are at the centre of the trade war, but are unlikely to be fatal for global growth. The United States exports 0.6% of its GDP to China. China has more at stake given it exports 3.6% of its GDP to the United States. However, even after the current geopolitical escalation, the direct effects at this stage are relatively small.

Although this conflict between the United States and China will create share market volatility, we remain positive that share markets will continue to push higher. Our optimism comes from the deluge of COVID-19-induced stimulus measures as governments and central banks prop up the global economy. This stimulus feeds through into a positive, albeit volatile, outlook for financial markets.

While share markets might shrug off much of the effect of a trade war, it is in currency markets where we expect the tension to play out. China’s currency fell in the wake of its plans to impose a sweeping national security law on Hong Kong. The renminbi weakened versus the United States dollar to the lowest level since September 2019. Allowing the currency to weaken helps China offset the impact of United States’ tariffs on its products.

NZ Funds’ positioning

An escalating trade war between the United States and China may push the New Zealand and Australian share markets lower due to their vulnerability to global trade. We wrote in 15 May 2020 | Home market bias that the dividend yields offered by New Zealand shares makes them more attractive than ever. NZ Funds’ dividend-focused approach to selecting shares is an ideal strategy for the current environment.

Therefore, we remain fully invested in the New Zealand share market. However, external influences mean we also retain diversification across global share markets, including the United States, Europe, Japan, China and Australia.

We are again witnessing geopolitical events influencing financial markets which until now have been dominated by the effects of COVID-19. We remain positive on shares and continue to expect the purchases we make today will deliver significant capital gains over the next two to three years.

We have hedged against the effect of the trade war to protect our Australian and New Zealand shares, which are potentially at risk from increased trade tensions. As a result, clients’ portfolios are in a position to profit from any weakness in China’s currency.

The trade war means both the United States and China may each further increase their stimulus packages to protect their respective economies from the fall out. Continued stimulus has long-term implications for inflation and, with interest rates likely to remain close to zero for some time to come, we retain a moderate position in gold for our clients.

Source: Bloomberg. For more information please contact NZ Funds.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

This document has been provided for information purposes only. The content of this document is not intended as a substitute for specific professional advice on investments, financial planning or any other matter.

While the information provided in this document is stated accurately to the best of our knowledge and belief, New Zealand Funds Management Limited, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed except as required by law.

James Grigor is Chief Investment Officer for New Zealand Funds Management Limited (NZ Funds) and a member of the NZ Funds KiwiSaver Scheme. James' comments are of a general nature, and he is not responsible for any loss that any reader may suffer from following it.

***